Our editorial team is independent and objective. To help support our review work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the CreditMashup site. This site does not include all companies or products available within the market.

We also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content.

While we work hard to provide accurate and up to date information that we think you will find relevant, CreditMashup does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

5 Top Credit Repair Companies of 2025

- Lisa Phillips

Our Top 5 Picks for the Best Credit Repair Companies of May 2024

The Credit People

Best for results in less than 60 days.

Credit Saint

Overall best for comprehensive package and pricing options.

Sky Blue Credit Repair

Best for low-cost credit-repair packages.

Dovly

Best for utilizing AI credit engine proven to optimize results.

Credit Pros Services

Best for 90-Day-Money-Back Guarantee.

Where do you start when you need a credit fix? Should you try to fix your own credit or hire a credit repair service?

Credit repair costs vary, ranging from hundreds to thousands of dollars but it can be worth it.

The first thing you should know is there’s nothing a credit repair service can legally do for you that you can’t do for yourself.

But there are 4 major factors you need to consider before you venture on a credit fix:

- Familiarity with federal and your state’s credit and debt laws.

- Ability to decide what negative credit items to dispute and which items to resolve through other methods.

- Time commitment to dispute and respond to creditors and credit bureaus.

- How to maintain good credit once it’s restored.

We researched many credit repair companies thoroughly to pick the best credit repair companies in the market.

Summary of Best Credit Repair Companies

The Credit People estimates a 50 to 100 score increase and has removed over 1.4M credit issues for customers.

Credit Saint’s staff is comprised of a team of professionals who provide monthly updates to clients along with information on how to build a positive credit history.

Features & Services

- Monthly fee: 79.99 monthly fee plus a one-time $99 setup fee

- 24-hour account access: Check the status of your account any time you want

- Free credit report evaluation: Review details of your credit history to identify damaging accounts

- Cancel anytime

Sky Blue offers a customizable credit repair service package that includes credit disputes, credit building guidance, mortgage preparation, and debt consolidation consultations.

Features & Services

- Offers a 90-day guarantee.

- Kinds of credit repair services: credit disputes, collections, repossessions, credit rebuilding, debt management.

- Monthly fee is $79 for a single person. Couples can get a $39 discount discount, making their monthly fee $119.

- Easy to pause or cancel membership.

Features & Services

- Free: One dispute per month with Transunion only.

- Premium $39.99 monthly (or $99.99 annually: Unlimited disputes with all three credit bureaus.

- $1 million of identity theft insurance

- Live US-based support.

- Real-time TransUnion score and report.

The Credit Pros’ staff is comprised of Certified FICO© Professionals with several years in the credit repair industry. Credit Pros specializes in disputing unverifiable, inaccurate, and questionable credit items.

Features & Services

- One-on-One Action Plan With a Certified FICO© Professional.

- Debt Validation, Goodwill and Cease & Desist Letters.

- ID Theft Restoration and Insurance.

- Monthly Plan with Unlimited Dispute Letters Available.

- Cost: $119.99 Setup – As Low as $69.00/mo.

- Cancel anytime plus 100% money-back guarantee.

5 Actions to take for a successful do-it-yourself credit fix

If you don’t know where to start your credit fix, here are 5 simple actions that will give you some direction.

1. Check your credit reports

To get a better understanding of your credit picture you must review your credit reports from Experian, Transunion and Equifax. Annualcreditreport.com offers free credit reports once a week. But they don’t offer credit scores. myFICO offers credit reports and FICO scores for a fee you can get anytime.

Once you have your credit reports do the following:

- Review the credit reports for errors and inaccurate information. Here are several tips on how to dispute negative credit.

- If you find information that is incorrect, send a credit dispute letter.

- Make sure you don’t have outdated information reporting. Outdated information can easily be disputed and removed.

2. Clear up charge-offs

One charge-off can take up to 150 points off your credit score. It can be detrimental to your credit scores compounded by the fact that months before your account was officially charged off, a number of late or missed payments occurred. Missed payments alone can significantly damage your credit.

Ways to remove a charge-off from reports:

- If the account has been sold to a debt collector, the original creditor must report a zero balance. If this is not the case, dispute the original creditor and request a deletion from your credit reports.

- Review the outstanding balance. If it’s more than you think it should be, dispute it and request a deletion. The creditor may simply correct the balance but it doesn’t hurt to request a deletion.

- Verify the charge-off date on the original account. The charge-off date should be the date of your first delinquent payment on the original account. Dispute the charge-off and request a deletion for any incorrect dates surrounding the account.

- Convince the creditor to remove the charge-off from your credit report in exchange for payment. There is no law that mandates creditors report your account information at all. The laws state that if information is reported to the credit bureaus, that information must be accurate.

3. Clear up debt collection accounts

Debt collection accounts have a big impact on your credit scores too. It makes it even worse when you have the original creditor reporting late payments and a charge-off. Your scores are doubly impacted. The best action for collection accounts is to get them removed from credit reports. Paying a collection account will not help your scores.

Ways to remove debt collection from reports:

- Ask a collection agency to remove the collection account from their credit reports in exchange for payment.

- If paying is not an option request debt validation. Ask the debt collector to prove you owe the debt.

- Dispute any inaccurate information surrounding the collection listed on your reports.

4. Improve your payment history

Payment history is one of the major components of your FICO scores. Late and missed payments will reduce your scores, and bankruptcies, public records and collections can cause significant damage. Negative information will remain on your credit report and impact your credit scores for 7-10 years. On time payments will have a positive impact on your credit scores.

Steps to take to improve your payment history:

- Bring accounts current

- Continue to pay on time

- Once you’ve caught up on payments and demonstrated a continued ability to pay on time, request your creditor remove the late payments as a goodwill gesture.

5. Pay down credit card balances

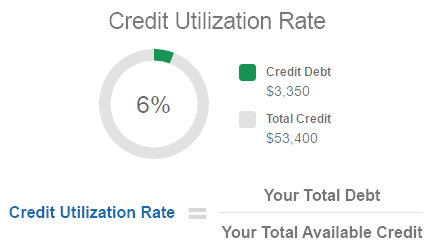

The next major component of your credit score is credit utilization rate. FICO scoring models take into account how much you owe compared to how much credit you have available. This is called credit utilization rate or balance-to-limit ratio.

Basically it’s the sum of all of your revolving debt (such as your credit card balances) divided by the total credit that is available to you (or the total of all your credit limits).

When you use a lot of your available credit your credit scores take a huge hit. The typical school of thought on how much of your available credit to use is around 30 percent. However, FICO has said in the past that people with the highest credit scores typically use no more than 7 percent of their available credit.

For example, if you have a $10,000 credit limit across all of your credit cards, you should try to keep your total credit card balances below $700 to keep your credit utilization rate low.

Here are ways to reduce credit utilization:

- Reduce your debt by paying off your account balances.

- Request a credit limit increase on an existing account or open a new account. But you must not use the additional available credit – that will defeat the purpose.

Once you reduce or pay off debt remember to keep the account open. The FICO scoring model factors in the age of your oldest account and the average age of all of your accounts. Consumers with longer credit histories are rewarded.

Stay up-to-date with your latest credit score information and learn what lenders know about your scores.