If you’re looking for tools to add to wealth-building, compound interest must be included in your toolbox. There’s a time value component to money and asset growth over time.

By far, compound interest is one of the easiest ways to have your money make more money with little effort. Compound interest helps you earn a higher return on your savings and investments.

So how does compound interest work

When examining compound interest, just think about your earnings EARNING earnings. The compound may sound complicated but it’s really simple. Earning compound interest occurs when your savings are reinvested to generate their own earnings.

How long does it take for compound interest to work?

As illustrated below, the longer a savings or investment window you have, the more you stand to benefit from compounding. In other words, while you can capitalize on compounding by investing for just a few years, your gains will be higher if your returns compound for 20 years instead.

Example 1 – Interest compounding annually from one savings deposit.

- You deposit $12,000 and make no additional deposits.

- The bank pays 5% interest (APY) on your deposit.

- After one year you gain $600.

- Year two is where the power of compound interest kicks-in. You’ll earn interest on your initial deposit, and you’ll earn interest on the interest you earned. So even though you didn’t make any deposits, your earnings still increase.

- At the ten-year mark, you would have earned a total of $7,546.75 in interest. Add that to your initial deposit of $12,000 for a total of $19,546.75.

*The above is an example of interest compounded yearly but if your bank compounds interest compounds daily, as with some online-only banks, the process is accelerated.

Example 2 – Interest compounding annually from one initial savings deposit plus monthly deposits.

- You deposit $12,000 and add a $100 deposit every month.

- The bank pays 5% interest (APY) on your deposit.

- After one year you gain $632.

- Year two is where you’ll see the power of compound interest as you’ll earn interest on your initial deposit, interest on your monthly deposit plus you’ll earn interest on the interest you earned, compounding your returns.

- At the ten-year mark, you would have earned a total of $$11,045.88 in interest. Add that to your initial deposit and monthly contributions of $24,000 for a total of $$35,045.88.

Example 3 – Interest compounding monthly from investments

Before investing in stocks, you have to take into consideration the stock market goes up and down. If you are averse to risk, consider investing more conservatively. But if you’re investing for a future financial goal, like retirement, consider investing more aggressively.

Invest monthly in stocks long-term.

- Invest $700 in stocks at age 35.

- Invest an additional $700 a month until age 66.

- Earn an 8% annual rate of return.

- In 30 years, the balance would be just over $1 million.

This example assumes you hold stocks over the long-term. A compounding effect occurs when you earn gains on your capital gains assuming you hold stocks over a long period with constant reinvestment. Warren Buffett Buffett is known as a long-term investor.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” Warren Buffett

Invest lump sum in stocks long-term.

- Invest $25,000 lump sum in stocks at age 35.

- Earn an 8% annual rate of return.

- In 30 years, the balance would be just over $250,000.

Example 4 – Investing for retirement

Start saving and investing early if you want to reach the $1 million for retirement. People who start saving for retirement in their 20s or 30s have a much easier time reaching $1 million for retirement. When you have a longer horizon until retirement and a decent rate of return, the power of compound interest will help you reach your financial goals, even on a small income.

Roth IRA. IRA is an individual retirement account. There is no tax deduction for contributions made to a Roth IRA. According to the Roth IRA funding rules established by the IRS, all of your contributions must be made with after-tax dollars.

- Invest an initial $6,000 in a Roth IRA at age 25.

- Invest an additional $6000 annually until age 66.

- Earn a 7% annual rate of return.

- At retirement, your balance would be just over $1.3 million.

Check the numbers for yourself

Example 5 – Interest compounding in credit cards

Compound interest can work against you. Most credit card issuers will compound an account’s interest charges daily. Interest is added to your principal (original) balance at the end of every day.

When you don’t pay your balance in full, interest accrues on your unpaid balance, so that you are paying interest on interest.

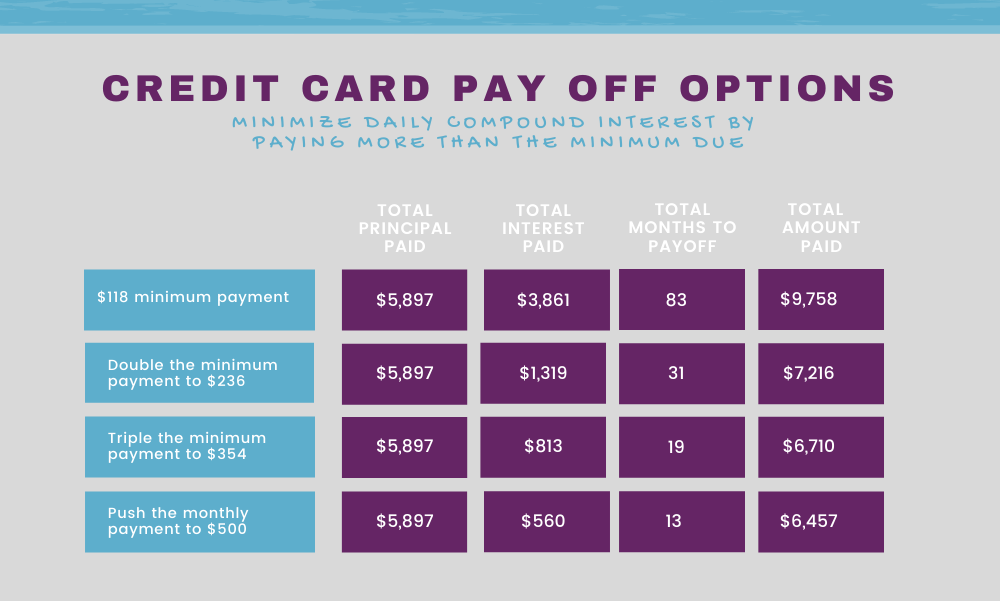

Compound interest can cause credit card balances to skyrocket, here is how: The average credit card balance is $5,897 according to Experian. The average credit card interest rate is 15.96% according to Bankrate.

Using these numbers let’s look at how compounding interest can work against you.

The bottom line is paying more than the minimum due also helps limit the interest you’ll owe over time and helps your credit utilization rate. The lower your credit utilization, the better your credit score.

How to start investing in stocks and bonds

Investing in stocks is easier than beginners might think — all you need is an online brokerage account to get started. If you are new to investing, financial companies like Acorns Invest take the guesswork out of investing. Acorn’s digital platform helps you to invest your spare change. All of your credit or debit card purchases are rounded up to the nearest dollar, the change is then invested into a computer-managed investment portfolio.

It’s really quite simple and straightforward. Everything is done online and automated. When signing up for Acorns Invest you’ll complete a short survey so Acorns can generate specific investment recommendations based on your goals. Start investing with as little as $5.

Acorns Features

- Account minimum: $5 minimum deposit required.

- Fees: $5 monthly fee.

- Investment types: Stocks, Fractional Share Investments in ETFs, Retirement Investing in Roth or Traditional IRA.

- Option to automate: Automatically invest a portion of your paycheck.

- Account types: Brokerage, Retirement and Checking.

- Other important details: Free financial counseling.

The power of compound interest in wealth building

The beauty of compound interest is that it reinvests the interest you’ve earned so that you’re essentially building interest on interest. By leaving your money in an account that grows it, you’ll end up with a healthy savings account. Earning compound interest is easy. You don’t have to do anything except getting money in an account, keep it there and let compound interest do its thing.

Albert Einstein referred to compound interest as “magic” and called it “The most powerful force in the universe…”.

At many banks, especially online banks, interest compounds daily and gets added to your account monthly, so the process moves even faster. But the difference is not significant until you’re working with hundreds of thousands of dollars.

No matter whether you start saving a lot or a little, the key is to start saving using compound interest. Save what you can – compound interest will do the rest of the work for you.

Final thoughts on the power of compound interest

People often talk about the magic of compound interest, but it’s up to you to put the magic in motion. The earlier you save, the more interest you accumulate due to compound interest.

Start saving early. Timing is everything when maximizing the power of compound interest. Compound interest accelerates the growth of your savings and investments over time assuming the money is left alone to grow. Compounding is more dramatic over long periods. Avoid withdrawals as much as possible. Compounding interest makes a difference even when making small contributions.

Compounding frequency matters. The above examples show an annual frequency of compounding interest, however, the frequency of compounding matters. More frequent compounding periods—daily or monthly for example—have better results. When opening a savings account, look for accounts that compound daily like online-only savings accounts. The fine print may state that interest payments are added to your account monthly, but calculations can still be done daily.

The higher the interest rate, the better. The interest rate is a top component in your account balance over time. Higher rates mean an account will grow faster. But even if you don’t have a high-interest savings account, compound interest can overcome that deficit over longer periods.