If you’re looking to improve your financial standing or get approved for a loan, you’ve probably heard of FICO scores and Credit Karma. But what’s the difference between the two, and why does it matter?

FICO scores are the most widely used credit scores by lenders, while Credit Karma offers free credit scores and reports based on data from two of the three major credit bureaus.

While both provide valuable information, it’s important to understand the nuances between the two to make informed financial decisions.

In this article, we’ll delve into the differences between FICO score versus Credit Karma, and why knowing these differences can help you take control of your financial future.

Understanding FICO Score

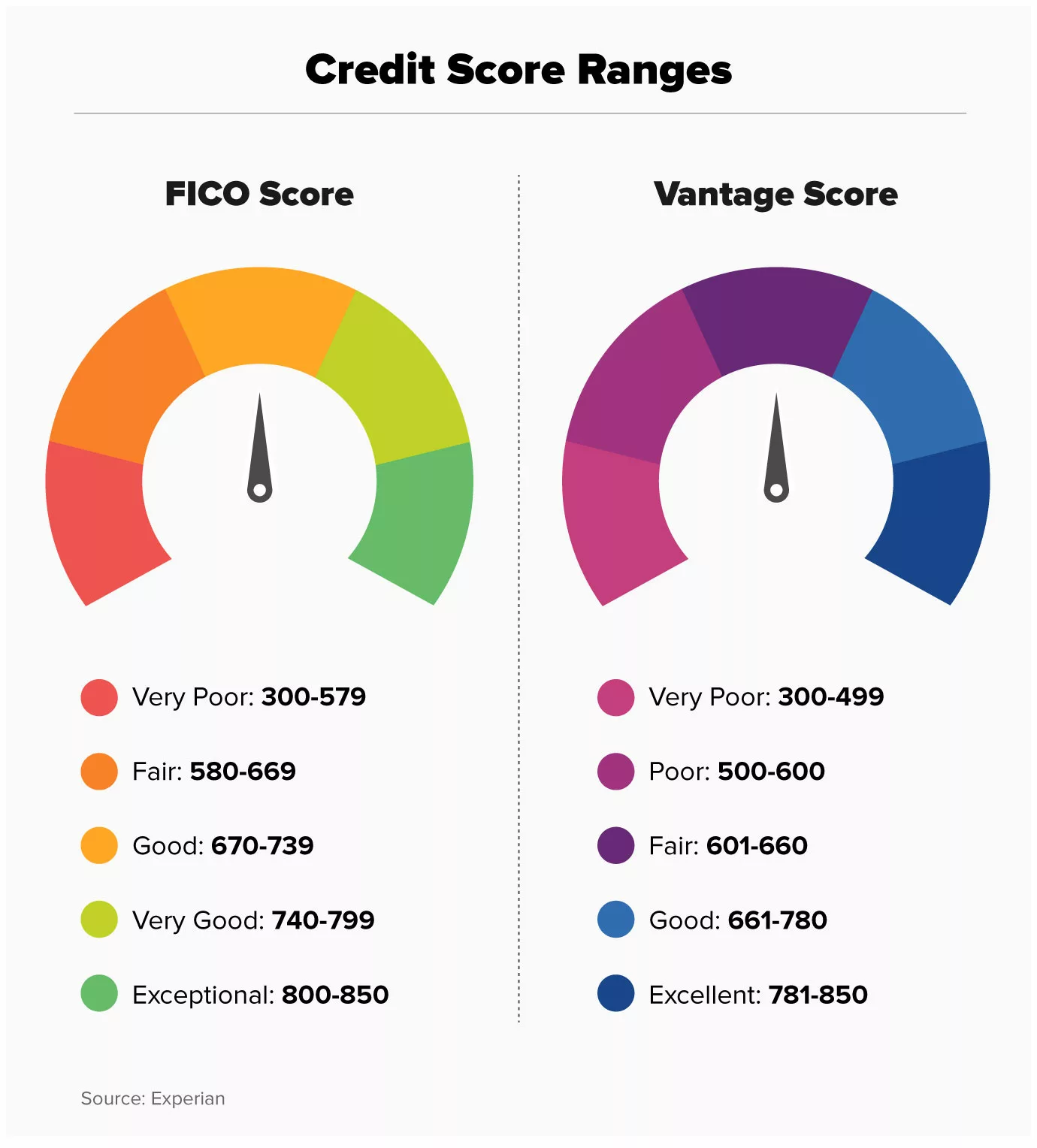

Your FICO score is a credit score created by the Fair Isaac Corporation (FICO) and is used by lenders to determine your creditworthiness. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Your FICO score is based on several factors:

- Payment history – 35% of score. This is the most crucial factor of your FICO score. Consistent on-time payments have a positive impact, whereas late or missed payments, charge-offs, and collections have a negative effect.

- Amounts owed – 30% of score. FICO assesses both installment and revolving loan balances, such as credit cards and lines of credit. Revolving accounts are weighed more heavily because they have varying payments. FICO also looks at your credit utilization ratio, which measures the amount of credit used versus your credit limit. The higher the ratio, the more it appears that you are overextended financially, which could harm your score.

- Credit history length – 15% of score. This factor considers the length of your credit history. The more history you have of timely debt repayment, the more creditworthy you appear.

- Credit mix – 10% of score. Lenders prefer borrowers who can handle different types of credit products. Having diverse account types can boost your score.

- New credit – 10% of score. Applying for numerous loans or credit cards at once can negatively impact your credit score, mostly because it shortens your average credit history length. This factor may not affect your score significantly, depending on your existing score.

Understanding Credit Karma

Credit Karma is a free online service that provides you with your credit scores and reports based the VantageScore® 3.0 model that employs data from two of the three major credit bureaus, TransUnion and Equifax. While this model assesses some of the same factors as the widely-used FICO scoring model, the VantageScore scoring model assigns a different weight to these factors:

- Payment history – 41% of score. This is equally important as in the FICO scoring model, and VantageScore evaluates current, late, charged-off, or collection payments.

- Depth of Credit – 20% of score. VantageScore analyzes both your types of credit used including installment and revolving along with account age.

- Credit utilization – 20% of score. VantageScore assesses the percentage of your credit limit used and how much credit you have access to.

- Recent credit behavior – 11% of score. Recent credit looks at the number of credit accounts you’ve recently opened and the number of hard inquiries showing on your report. Opening multiple accounts simultaneously may harm your score.

- Total balances – 6% of score. This factor looks at the total balances remaining on all of your credit accounts, both current and delinquent. High balances can hurt your score, even if you’re current on all of your payments.

- Available credit – 2% of score. VantageScore considers how much credit you have available on your revolving credit accounts.

Credit Karma also offers credit monitoring services, personalized recommendations for credit cards and loans, and tools to help you improve your credit score.

Fico Score versus Credit Karma – Key Differences

The key difference between FICO scores and Credit Karma is the source of the credit score. Take a look:

FICO Scores

- FICO score provides credit reports and scores from the major credit bureaus Experian, TransUnion and Equifax.

- FICO scores are created by the Fair Isaac Corporation and used by 90% of top lenders.

- FICO scores are typically updated once a month if you have subscribed to a plan or have other options to get a free FICO Scores.

- If you access your credit report and FICO scores through the official site at myFICO.com, you get access to the FICO Score Simulator.

- You can choose from 24 score simulations and automatically see a simulated FICO Score 8 based on the actions you choose.

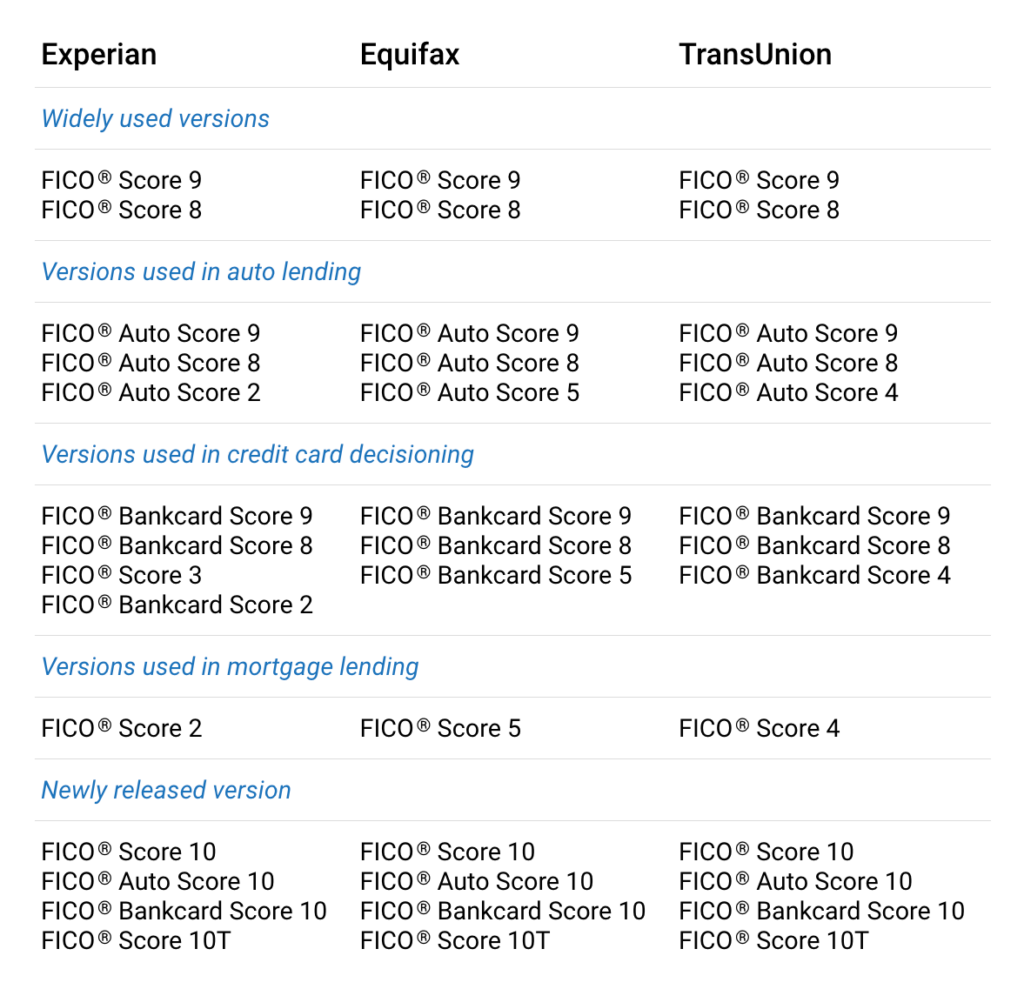

- FICO gives consumers access to industry-specific versions of scores, for example:

VantageScores

- Credit Karma, on the other hand, provides VantageScore credit reports and scores from only two major credit bureaus, TransUnion and Equifax.

- VantageScores are used by over 2,600 financial institutions.

- People that join Credit Karma can get weekly updates of their TransUnion and Equifax VantageScores. This can be helpful if you’re actively working to improve your credit score or if you’re monitoring for any suspicious activity on your accounts.

- Credit Karma also offers a credit simulator tool that allows you to see how your credit score might change based on different scenarios, such as paying off a debt or opening a new credit card.

How FICO Score and Credit Karma impact your creditworthiness

Your FICO score and Credit Karma score both impact your creditworthiness, but they do so in different ways. FICO scores are the most widely used credit scores by lenders, and a high FICO score can help you get approved for loans and credit cards with favorable terms. A low FICO score, on the other hand, can make it difficult to get approved for credit or may result in higher interest rates.

Credit Karma scores, while not as widely used by lenders as FICO scores, can still impact your creditworthiness. Your Credit Karma score provides a snapshot of your creditworthiness based on data from two of the three major credit bureaus. While lenders may not use your Credit Karma score directly, it can give you an idea of how lenders may view your creditworthiness.

Advantages of using FICO Score

One of the advantages of using FICO scores is that they are the most widely used credit scores by lenders. This means that a high FICO score can help you get approved for loans and credit cards with favorable terms.

Another advantage of using FICO scores is that they are consistent across all lenders. This means that your FICO score will be the same regardless of which lender or credit bureau you use and can be helpful if you’re shopping rates and terms for loans or credit cards.

Consumers can pay for a subscription to myFICO to get access to credit reports and scores but there are alternative ways to get free FICO scores and free credit reports from the major credit bureaus.

Advantages of using Credit Karma

One of the advantages of using Credit Karma is that it’s free. Credit Karma also offers credit monitoring services, personalized recommendations for credit cards and loans, and tools to help you improve your credit score.

Another advantage of using Credit Karma is that it provides you with updates on your credit score and report on a weekly basis. This can be helpful if you’re actively working to improve your credit score or if you’re monitoring for any suspicious activity on your accounts.

Which one is more important – FICO Score or Credit Karma?

Both FICO scores and Credit Karma can provide valuable information about your creditworthiness. However, FICO scores are the most widely used credit scores by lenders and can directly impact your ability to get approved for loans and credit cards with favorable terms. This means that a high FICO score is generally more important than a high Credit Karma score.

That being said, Credit Karma can still be a useful tool for monitoring your credit score and report, as well as identifying areas where you can improve your creditworthiness. By using both FICO scores and Credit Karma, you can get a comprehensive view of your creditworthiness and take steps to improve your financial standing.

Tips for improving your credit score

If you’re looking to improve your credit score, there are several steps you can take:

1. Pay your bills on time. Your payment history is the most important factor in your FICO score, so it’s crucial to make payments on time.

2. Reduce your debt. Amount owed accounts for 30% of your FICO score, so reducing your debt can help improve your credit score.

3. Keep old accounts open. Length of credit history accounts for 15% of your FICO score, so keeping old accounts open can help improve your credit score.

4. Don’t apply for too much new credit. New credit accounts for 10% of your FICO score, so applying for too much new credit at once can hurt your credit score.

5. Monitor your credit score and report. By monitoring your credit score and report, you can identify areas where you can improve your creditworthiness.

Conclusion

Understanding the differences between FICO scores and Credit Karma can help you take control of your financial future. While FICO scores are the most widely used credit scores by lenders, Credit Karma can still provide valuable information about your creditworthiness.

By using both FICO scores and Credit Karma, you can get a comprehensive view of your creditworthiness and take steps to improve your financial standing.

So whether you’re a seasoned investor or just starting out on your financial journey, make sure to use both FICO scores and Credit Karma to stay on top of your credit score and report.