Customized debit cards allow you to express yourself and put your creativity on display. But not all banks offer personalized debit cards.

As a sports fan, a supporter of a special cause, art lover, or alumnus, you don’t have to miss out on a personalized debit card.

A prepaid debit card issuer offers a good option for a customized debit card if your bank does not offer them. Prepaid debit cards let you spend the money you load onto the card. You can load money onto a prepaid debit card in several different ways:

- Load money onto the card via cash

- Mobile deposit checks

- Direct deposit from an employer or benefits like SSI or retirement

- Transfer from a bank account

Here are a few ways to get a customized debit card that says something about you.

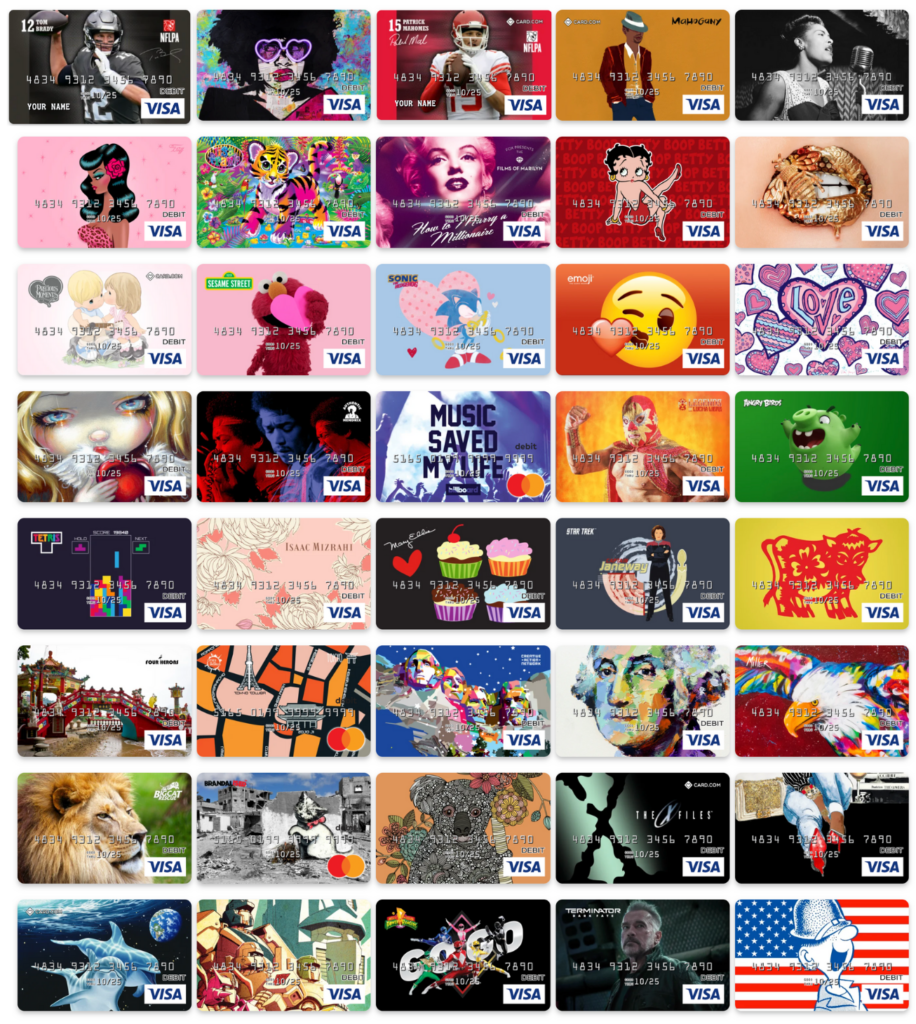

Card.com offers multiple debit card design categories

About the CARD.com Account – $50 Bonus

Card.com is a Prepaid Visa issued by Bancorp Bank. With direct deposit, you can get paid up to 2 days early. Loading cash is easy with Reload at the Register. Just bring your card and cash directly to the register at over 90,000 participating retail locations.

This account accommodates people with bad credit because there is no credit check or ChexSystems to open.

Get a $50 Bonus when you sign-up for direct deposit with a $200 deposit or more of a payroll check or federal benefits within 60 days of account opening.

Card.com Account Features

- Minimum opening deposit $0.

- Get paid up to 2 days early with direct deposit.

- No monthly fee with direct deposit of $1,000.

- 32,000 Fee-Free MoneyPass® ATMs.

- Load cash at 7-Eleven, Western Union, Walmart, Walgreens, Dollar General, Rite Aid, Ralphs, Krogers, and many other participating retailers.

- Transfer funds from a virtual wallet such as PayPal or Google Wallet.

- No overdraft or non-sufficient funds fee.

- Stay up-to-date with Rapid Text Alerts.

Custom debit card designs include:

- Animals & Nature

- Art & Fashion

- Automotive & Sports

- Caring & Awareness

- Cartoon & Comics

- Cute & Colorful

- Emoji & Memes

- Famous People

- Fantasy & Sci-Fi

- Flags & Cities

- Food & Drink

- Goth & Alternative

- Music & Bands

- Schools & Colleges

- Science & Technology

- TV & Movies

- Video Games & Apps

Prepaid cards have some protections. Prepaid cards in a payment network such as Visa or Mastercard might enjoy zero liability protections. Additionally, in 2019 the Consumer Financial Protection Bureaus enacted a rule which gives prepaid accounts federal protections that already exist for checking accounts and credit cards. It also provides greater protection from loss, theft or incorrect charges, according to CFPB.

Prepaid cards can help you stay on budget. Most prepaid cards won’t allow you to spend more than the balance in your prepaid account. In a way prepaid cards force you to stay on budget, you can’t spend more money than you have on your card.

Lastly, using a prepaid card as a budgeting tool is a good idea because it helps keep track of your money. You can avoid checking account overdraft fees and credit card over-limit fees by using a prepaid debit card.