Brokerage accounts allow investors to purchase shares in companies for less money than buying directly through stock exchanges. This means that brokers can offer lower prices on stocks and other investments.

What is a Brokerage Account?

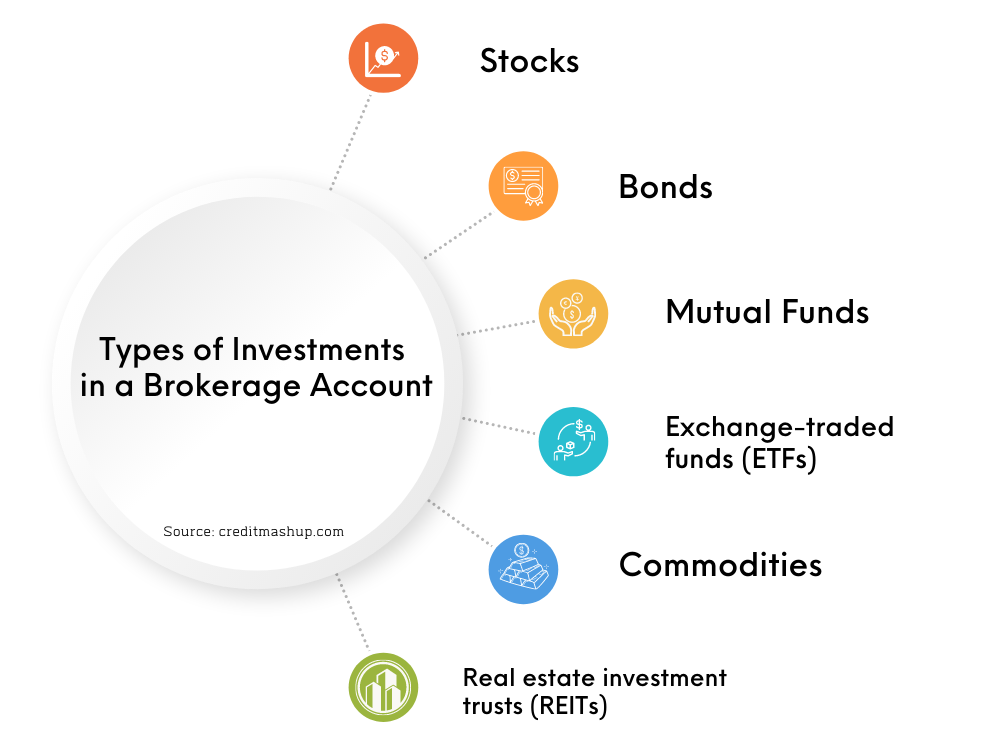

A brokerage account enables you to trade financial products like stocks, bonds, exchange traded funds (ETFs), real estate investment trusts (REITs) and mutual funds directly using the broker’s own trading platform or third-party platforms.

When you open a brokerage account, the firm buys and sells investing assets on your behalf because the average consumer cannot execute trades directly with the Stock Exchange.

Trades must be performed through a licensed brokerage firm that acts as a middleman between you and your money. The brokerage firm is also the custodian for the securities you own in your brokerage account.

How Brokerage Accounts Work

There are two common types of brokerage accounts: cash accounts and margin accounts.

- Cash account — With a cash account, you purchase investments with the money you’ve deposited in the account. If you have $1,000 in the account, you can only buy $1,000 worth of securities.

- Margin account — A margin account is essentially a loan made by a brokerage firm to an account owner, thereby increasing your buying power. Margin accounts require a minimum of $2,000 in net worth to establish a long stock position. Learn about the risks of using margin accounts at Investor.gov

What can you do with a brokerage account?

You can use your brokerage account to buy stocks and other types of investments.

- Buy and sell stocks, mutual funds, ETFs, and other securities.

- Take advantage of potential long-term growth.

- Set aside money for your retirement, or other goals like college tuition or a down payment.

- Gain access to investment research, tools, and strategies.

Benefits of Investing

There are benefits of investing in stocks but there’s also the risk your investments may lose value. The average stock market return is historically 10% based on the S&P 500.

The S&P 500 index acts as a benchmark of the performance of the U.S. stock market overall, dating back to the 1920s. But realistically, that 10% market return figure is more like 6% to 7% when accounting for inflation. Benefits of investing in stocks:

- Stocks provide exposure to the market as a whole.

- Stocks give investors a chance to earn interest on their money.

- Stocks are relatively easy to understand. They are traded on stock markets, so anyone with access to the internet can learn how to invest.

- Finally, there are no transaction costs associated with stocks. That means that investors do not need to worry about paying any fees when purchasing stocks.

Risks of Investing

No one can guarantee that you’ll make money from your investments. The higher the risk, the higher the potential return. But the key term here is “risk”.

Investments cannot be insured due to the element of risk to investing. The Securities Investor Protection Corporation (SIPC) is a nonprofit membership corporation that protects customers of SIPC-member broker-dealers if the firm fails financially.

Coverage is up to $500,000 per customer for all accounts at the same institution, including a maximum of $250,000 for cash.

But the SIPC does not protect investors if the value of their investments falls. Risks of investing in stocks:

- Stocks are subject to volatility and market risk. Market conditions, the economy, supply and demand are just a factors that affect stocks. If people are pulling capital out of the stock market in general, then stock prices are going to fall.

- Stocks are impacted by company-specific risks. You can lose money if you own shares in a company that fails to produce enough revenue or profits.

- Inflation is a risk for investors receiving a fixed rate of interest. Inflation reduces purchasing power and erodes returns.

- Liquidity can be a risk for more complicated investment products where it may be difficult to find a market to sell the investment.

Based on historical data you can reduce risk by diversifying and holding your portfolio of stocks over an extended period of time.

For lower-risk options you’ll want to stick with high-yield savings accounts that are insured by the FDIC up to $250,000.

The FDIC does not insure money invested in stocks, bonds, mutual funds, municipal securities, or money market funds, even if these investments were bought from an insured bank.

Expect to earn a lower return in exchange for an FDIC-insured savings account. Here’s our list of the best high-yield online savings accounts.

Opening An Online Brokerage Account

Opening a brokerage account is one of the first steps to building your personal investment portfolio. There are two main online options that meet the needs of most investors: online brokers and robo-advisors.

- Online brokerage firm — Many brokers allow you to open a brokerage account online and typically only require a minimum balance to start investing. The broker holds your account and acts as an intermediary between you and the investments you want to purchase and you can sell investments at any time. Online brokers have the least expensive brokerage fees.

- Robo-advisors — Computer algorithms and advanced software build manage your investment portfolio when using robo-advisors. Robo-advisors let you get started investing immediately and require little to no human interaction. Robo-advisors charge far less than a human advisor, often just 0.25% to 0.50% of assets under management, which is far below the traditional asset management fees charged by human advisors.

- Traditional brokers — Investing with traditional full-service portfolio management typically requires high balances to start. Full-service brokers offer a wide range of products and services such as estate planning, tax consultation and preparation, and other financial services either in-person or over the phone. The standard commission for full-service brokers today are between 1% to 2% of a client’s managed assets.

You can open a brokerage account online by visiting a site like the following:

SoFi Active Investing

SoFi is a good fit for beginner investors with lots of educational tools and a high-quality mobile experience.

Pros

- $0 stock and ETF commissions

- Buy fractional shares of stock

- Trade cryptocurrency 24/7

- Retirement accounts

- Low account minimum

- High-quality mobile app

Cons

- No mutual funds

- No stock option trading

Once you’ve opened an account, you can start buying and selling stocks using your computer or mobile device.

What are the benefits of investing through an online brokerage firm

There are several benefits to investing through an online brokerage account or robo-advisor.

First, you won’t have to pay any commission or fees when you buy or sell stocks.

Second, you can use your brokerage account to invest in mutual funds, exchange traded funds, and other investment vehicles.

Third, you can access your investments 24/7 via your computer or mobile device, so you can make changes at any time.

Fourth, you can easily track your portfolio performance with real-time quotes and charts.

Finally, you can also set up automatic transfers between your brokerage account and your bank account, making it easy to manage your money.