On July 13, 2012, Mastercard, Inc. and Visa, Inc., along with major credit card companies agreed to pay more than $6 billion to settle an anti-competitive practices lawsuit involving payment processing.

The settlement is the result of a 2005 lawsuit brought on behalf 7 million merchants in federal court. Some of those merchants are major retailers such as Safeway, Walgreens, Target, Ralphs, Walmart amongst others.

The lawsuit accused Mastercard, Visa and the major credit card companies of price-fixing in order to charge high fees for processing credit card payments. The retailers pay the merchant fees to the credit card companies to accept credit card payments from customers.

The merchants also claimed the payment processors banned stores from requiring their customers to use less expensive methods of payments such as cash and checks in order to save the retailer from having to pay the fees for accepting credit cards.

As part of the settlement, MasterCard and Visa will reduce the charge to process transactions for 8 months which the plaintiffs estimate will be worth $1.2 billion.

The victory of the merchants comes on the heels of another victory over what financial firms can charge them when customers use a debit card. The Dodd-Frank financial reform law resulted in banks reducing “swipe fees” that they collect from merchants each time a customer makes a purchase with a debit card.

Now, under the credit-card settlement on July 13, 2012, merchants will be able to charge higher prices to consumers who decide to pay for their purchases with credit cards.

Prior to the settlement Mastercard, Visa and other major banks banned merchants from adding this kind of surcharge to customers.

Would you pay extra to use a credit card?

The attorneys for the merchants stated the merchants may not necessarily charge for credit card use but rather use it as leverage to force credit card processors to reduce the amount they charge merchants.

The American Bankers Association said in a statement that while the banks “may not like all the results in this case, our industry is ready to put this matter behind us.”

But retailers have been longing for an opportunity to charge more for customers using credit cards. The thought behind this is the greater the fees, the more reduction in overall cost for accepting plastic.

But retailers have been longing for an opportunity to charge more for customers using credit cards. The thought behind this is the greater the fees, the more reduction in overall cost for accepting plastic.

Craig Wildfang, a lead counsel in the lawsuit and partner at Robins, Kaplan, Miller & Ciresi LLP, said “Even if only a few merchants surcharge, everyone will benefit. It will have a downward pressure on merchant fees.”

According to Mr. Wildfang, merchants pay roughly $40 billion in fees each year to MasterCard and Visa issuing banks.

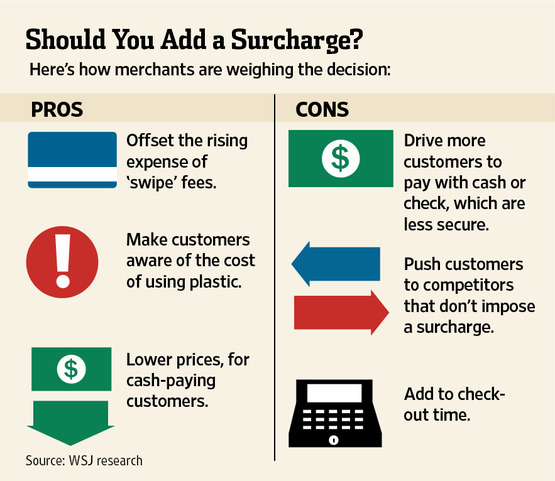

Business owners are wrestling with the decision

For many years business owners wanted a way to recoup the so-called “swipe fees” which can be from 1% and 3% of the purchase. But credit card issuers have prohibited retailers from imposing a surcharge on cardholders. Consumers generally are not aware of the fees merchants must pay.

Business owners had to weigh the cost of a customer charging small items which resulted in little profit because of the fee merchants had to pay Mastercard, Visa and other credit card companies for accepting credit cards. That’s why in some stores you see a sign stating the minimum amount that can be purchased on credit cards.

Now that business owners can recoup the swipe fees some may be grabbling with the decision. Anyone who accepts credit cards which includes your local grocery or convenience store, your favorite department store, your doctor; and even your favorite deli, can pass the “swipe fee” onto customers. There is a cap on the amount merchants can impose. The surcharge cannot be more than the merchant’s costs.

According to the Wall Street Journal, “…Some merchants say they are wary about angering their customers…for about two dozen small-business owners from various industries and regions, the prevailing opinion was that surcharges could do more harm than good, and might drive customers to competitors.”

It remains to be seen if retailers will impose the surcharge on customers to recoup their fees; although not all retailers will be entitled to impose a surcharge as 10 states prohibit merchant surcharges.

The surcharge will not go into effect until the settlement gets approval in U.S. District Court which might not occur until the end of the year.

Will you pay the extra surcharge for the convenience of using a credit card?