The computer age continues to bring many useful and positive advances in technology. But, the computer age has also given rise to seemingly endless fraudulent activities designed to scam consumers.

Scam artists are known for taking legitimate financial services and morphing them into mechanisms that cause victims not only lose money, but often lose time trying to resolve the issues caused by the scam.

Any consumer who has been victimized as a result of a scam will tell you how difficult it can be to restore your finances. Here are ongoing common scams to be careful of:

Debit Card Skimming Scam

Swiping your debit card is convenient but risky. Skimming devices are getting more sophisticated as technology advances. These skimming machines have been found at gas stations, restaurants, retail stores and ATM machines.

Skimmers record data stored on the magnetic stripe of your credit or debit card, which is then transmitted to thieves to make duplicate cards. Tiny cameras are also used to capture your PIN when you enter it on the keypad. These skimmers are so well disguised, rarely do consumers realize they are being duped.

Occurrences of ATMs being breached increased sixfold from 2014 to 2015 and rose again in 2016 by 30 percent, according to FICO, an analytics software company. In June 2017, the Federal Trade Commission put out a public warning, with tips on how you can avoid having your card information stolen.

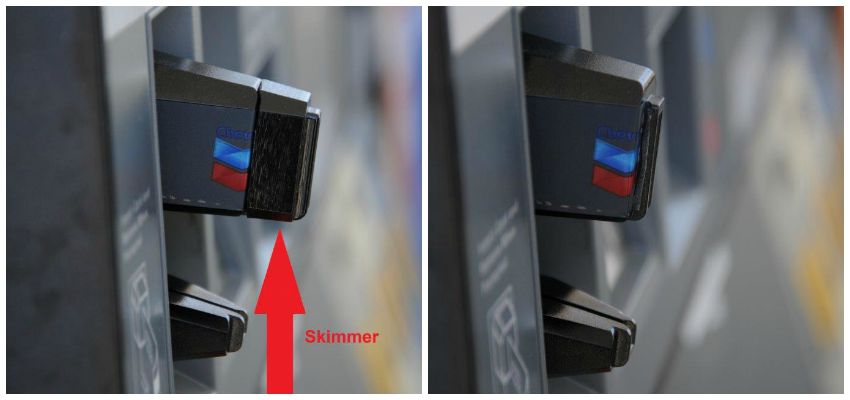

This is an example of a gas station card reader with a skimmer attached. The card reader on the left has a skimmer attached; the reader on the right doesn’t.

(Image Credit: consumer.ftc.gov)

Here are a few tips to protect your debit or credit card from scammers:

- Cover your hand when you input your PIN. Scammers can look over your shoulder, use binoculars from a remote location or have a tiny camera watching you.

- Look for skimming devices or other signs of tampering, like glue, loose components or scuff marks, before using an ATM, particularly one in low-traffic areas.

- Set a daily limit on ATM withdrawals.

- Use your bank’s ATMs. According to FICO, 60% of all skimming incidents occurred at non-bank ATMs — avoid randomly located ATMs like those inside gas stations.

- Never use a debit card at the gas pump, go inside to pay.

- Use a credit card instead of a debit card. Credit cards come with better protections against fraud. If you cannot qualify for a credit card due to bad credit, get a secured card that does not require a credit check to get approved.

Credit Repair Scams

Many credit repair companies offer a legitimate, much needed service that helps consumers get back on track with their personal finances and credit scores.

But the scam companies often charge upfront fees and promise to raise your credit score in 30 days or less.

Depending on how bad your credit is, it may take 6, 9 or even 18 months to improve credit scores. There is no set time to repairing credit as each consumer has individual issues.

Many of the credit repair services offered by these scam companies is something you can do yourself or is just outright illegal. Avoid any credit repair company that says they can start a new credit file for you. It’s illegal and may get you in criminal legal trouble. Never use an IRS tax payer identification number (TIN) as your SSN or a CPN which is what some of these scam credit repair operations suggest. Let a law firm repair your credit

Equifax Data Breach

In 2017 Equifax announced a data breach that affects 145 million consumers. Everything from consumers Social Security numbers, birth dates, addresses to driver’s license numbers was hacked. In addition, 209,000 credit card numbers were exposed. Monitor your credit profiles, bank accounts, credit cards and even taxes for scam artists.

While Equifax extended their offer of free credit freezes to June 30, 2018 (they should be forced to offer lifetime freezes); they have no plans to protect you from tax fraud. Scammers armed with your SSN can file tax returns with the IRS. File early as possible to prevent scammers from filing before you do.

A credit freeze can help prevent access to your credit files which could prevent scammers from using the hacked data to open bank accounts, open fraudulent lines of credit or loans in your name.

Everyone, whether or not affected by the breach, can request Equifax place a credit freeze on their credit files. Typically, a credit freeze costs up to $10, depending on what state you live in. Once you’ve frozen your credit an authorization by you is required to temporarily lift the freeze if you want to apply for credit. Some states charge a fee for lifting the freeze.

But freezing your Equifax credit report could still leave you vulnerable to scams. In order to protect your credit files at Experian and Transunion, you’ll have to request they place a freeze on your credit files too. It may be time-consuming but freezing all your credit files at the 3 major credit bureaus is the best action you can take to protect yourself from the Equifax breach.

Equifax also offered a one-year credit monitoring service, TrustedIDPremier, but the deadline to sign-up was Jan. 31, 2018. Equifax has since launched a new “Lock & Alert” product that allows consumers to quickly lock and unlock their Equifax credit report online or via a mobile app. It is free for life and available to U.S. consumers with an Equifax credit report.

A credit monitoring service can be very useful as an identity protection service. An identity theft service like LifeLock can to help you prevent, detect, and resolve identity fraud. In December, Javelin Strategy & Research, a California firm, assessed 18 leading identity protection services and Lifelock Ultimate Plus was rated as a leader in identity theft protection.

Prepaid Card Scam

Prepaid cards have been useful to consumers without a traditional bank account or credit cards. The problem with prepaid cards is regulation. The Consumer Financial Protection bureau has created comprehensive consumer protections for prepaid financial products that will take effect on April 1, 2019. Or, get the protection a real bank account offers even if you are in ChexSystems. Open an account at a bank that does not use ChexSystems.

The new rules will make prepaid accounts safer to use. But until then, there are certain prepaid card scams to watch out for:

- Keep the serial number on a prepaid card private. Never disclose it over the phone.

- Don’t send prepaid cards through the mail.

- If you are buying online, and someone tells you to pay with a specific prepaid card, make sure that the seller is approved by the card company. You will find that information on the card’s website, which is often listed on the back.

- If anyone calls and tells you that you must use your card to pay an unpaid bill, it’s probably a scam. If you think you may have an unpaid bill, call the company directly to confirm.

Recently, USAToday ran a article about a Mich. woman who deposited $980 on a GreenDot prepaid card to pay a utility bill she did not owe. The article said the scammer created a “do-it-now-or-else sense of urgency” which prompted the woman to react. Once she purchased the GreenDot prepaid card, scratched off the back to reveal a number on the back of the card and then read that number to the person on the phone – the money was gone. The scammers immediately transferred the cash to another account to access the money at an ATM or spend it online.

As scam artist stay a step ahead in technology and techniques to steal your money you must always be aware of your personal financial information and NEVER send any money until you verify the person on the other end of the phone.

Micro Charges to Credit Cards Scams

In 2010, the Federal Trade Commission filed a case against API Trade, LLC. The case involves front companies used by scam artists who made small charges to consumers’ credit and debit cards to make close to $10 million.

The majority of consumers did not detect the small charges because they ranged from .20 cents to $9. The scammers usually made only one fraudulent charge per credit card.

Approximately100 fake LLC’s companies were set up and used to process 1.35 million fraudulent credit card transactions. Websites were set-up along with phone numbers and virtual office addresses.

The FTC has yet to determine where the scammers obtained the credit card numbers but all of the money was laundered overseas. The operation ran from 2006 through 2010, when the FTC shut it down.

It’s been some time since this scam operation was shut down; but still carefully review your credit card statements each month and question any charge, no matter how small, you did not make. Dispute the charges with your credit company.