If you have ever been contacted by a debt collector regarding a debt you are sure is not owed, you are not alone. Phantom debt is on the rise and becoming a very lucrative practice — although it is illegal.

Phantom debt is debt that you do not legally owe. The continued growth of the junk debt industry has resulted in all kinds of illegal practices and scams.

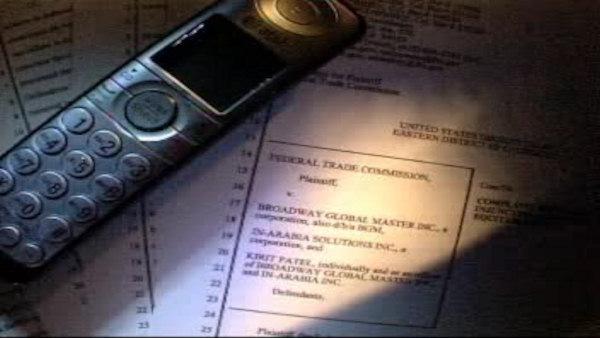

In 2016, the FTC along with the New York Attorney General’s office filed a complaint against a company calling itself “Delaware Solutions” and “Clear Credit Solutions.” They were attempting to collect payday loan debts but the debts were fake. The complaint says the company continued to deceive, harass, threaten and intimidate people into paying what they didn’t owe.

Aug. 2017, the FTC shut down a debt collection operation in Charlotte, NC where they pretended to be lawyers. Not only were the debt collectors not lawyers, they had no authority to collect debts. The imposters told people they were delinquent on a payday loan or other debt and threatened them with arrest, jail time, or getting sued unless they paid by credit or debit card over the phone. People were pressured into paying debts they never owed.

Types of Phantom Debt

Phantom debt can come from several sources. It can be debt owed by a deceased spouse or parent, a debt that was previously paid in full, a debt discharged in bankruptcy, a debt you never owed, and even a debt that is past the statute of limitations and not legally collectible. Phantom debt is basically “made up debt.”

How Debt Collectors Get Away with the Practice

Debt collectors are well aware consumers can be caught off guard when contacted out of the blue by a debt collector. The element of surprise can take a turn for the worse very quickly once a debt collector engages in abusive debt collection practices such as threatening legal action.

Debt collectors engaging in collecting nonexistent phantom debt hope you are not aware of your rights and simply agree to pay. Their illegal tactics can include frequent, harassing telephone calls to your home or employer; threats of visits to your home; and even threats of jail time even though the U.S. does not have a debtor’s prison. There are no lows these types of debt collectors will not sink to in order to extort payment.

All of these tactics violate the Fair Debt Collection Practices Act and consumers who are victims can and should sue for actual and punitive damages. Section 807 of the FDCPA says “(4) The representation or implication that nonpayment of any debt will result in the arrest or imprisonment of any person or the seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action.”

Even a threat to take an action that cannot legally be taken or that is not intended to be taken is a violation of the FDCPA.

How to Avoid being a Victim

Consumers can avoid being a victim of phantom debt by knowing your rights. First, if a debt collector calls you stay calm and do the following:

Do not discuss the debt. Inform the debt collector you will not discuss any debt until you receive a written “validation notice.” The FDCPA requires a debt collector provide a written notice of a debt within 5 days of their first communication with you. But don’t be surprised if you never receive ANYTHING in writing from a debt collector engaging in phantom debt.

The notice must include the amount of the debt, the name of the creditor you owe, and your rights under the federal Fair Debt Collection Practices Act.

Get information. Request the name of the debt collection company, their address and telephone number, then politely tell them you expect a written notice of the debt within five days as required by law.

Stop communicating with a debt collector. Write a letter demanding no further telephone communication and send it certified, return receipt. Retain a copy for your records. By law a debt collector must stop calling you at home and work once you make the request in writing. Here is a sample letter.

Never acknowledge you owe a debt. You must NEVER acknowledge you owe a debt or agree to pay; and most importantly, never reveal your financial information or confirm your social security number to any debt collector. Let’s say you are familiar with the debt but it is old and the statute of limitations has passed. If you agree to pay the debt you may end up re-starting the statute of limitations which means you can now be sued in court for the debt. Stay off the telephone and do not discuss the debt.

Report the Debt Collector

A debt collector cannot misrepresent the amount owed on a debt. Just by a phantom debt collector stating you owe a debt that is nonexistent, the law has been violated. A complaint should be made with your State’s Attorney General as well as the Consumer Financial Protection Bureau. Your attorney general can be a viable resource in fighting a debt collector. Some will even contact a debt collector directly, on your behalf, once a complaint has been made. Debt collectors do not like being contacted by attorney generals.

Who is Really Calling You

Many consumers have been forced to use payday loans. Unfortunately some online payday lenders have been compromised. A story on ABC News reported an enormous scam perpetrated by an organized crime operation in India. Americans who had applied online for a payday loan; and, in most cases repaid the loan, received abusive calls from an overseas call center.

The calls were part of a massive scam targeting over 600,000 Americans. The organized crime operation had access to personal information from the application and the debt collector calls seemed legitimate to many who were victimized.

The fake debt collectors threatened everything from legal action to jail time to having child services take the victims’ children. Victims of the phantom debt scam often received dozens of calls per hour.

Even though the supposed debt collectors had Indian accents; and, in many cases the victims had previously paid the payday loan in full, more than $5 million was collected before the scam was busted in April 2012. Legitimate payday loan companies may have outsourced business to call centers in India and real names and personal information of American customers could have been compromised.

The FTC case alleges “…that information submitted by consumers who applied for these loans online found its way into the defendants’ hands. Because the callers had this information – which often included Social Security or bank account numbers – and because many of the victims already were in a tenuous financial situation, they often believed that they owed the defendants the money, according to the FTC. In some cases, when consumers made the allegedly bogus payments, they had nothing left over to cover legitimate expenses…”

How one man fought back

Andrew Therrien, a salesman from Rhode Island fought back over two years after a debt collector threatened to rape his wife in 2015. Mr. Therrien began to receive threatening calls about a debt he did not owe. But the debt collectors had no idea what they were about to experience by messing with the wrong consumer.

Over the next two years, Therrien spent hundreds of hours turning the tables on the debt collectors. Here is an excerpt about the saga from Bloomberg.com:

By day [Therrien] was still promoting ice cream brands and hiring models for liquor store tastings. But in his spare time, he was living out a revenge fantasy. He befriended loan sharks and blackmailed crooked collectors, getting them to divulge their suppliers, and then their suppliers above them. In method, Therrien was like a prosecutor flipping gangster underlings to get to lieutenants and then the boss. In spirit, he was a bit like Liam Neeson’s vigilante character in the movie Taken — using unflagging aggression to obtain scraps of information and reverse-engineer a criminal syndicate.

When Therrien reached the top he found Joel Tucker, a billion-dollar businessman from Kansas City, Missouri. He recorded a conversation with the top-dog debt collector and here is an excerpt from Bloomberg:

Tucker seemed hyper and defensive, telling Therrien that if any of the portfolios he’d sold now contained phantom debt, they must have been doctored after leaving his hands. “F—ing shame on them,” he said. “Wasn’t me. It had to have been them.”

Therrien was trying to hold back his anger, but his voice wavered. He wanted to impress Tucker, mentioning tidbits he knew about his business. Tucker didn’t understand why Therrien, this guy he’d never met, was so extravagantly invested.

“I’ll tell you why I care,” Therrien said calmly. “I’ll tell you why I care. I believe, and I’m just telling you what I believe, you sold my personal information 21 separate times. I’ve gotten close to 100 f—ing calls, and because I’ve gotten those 100 calls from scumbag collectors that you facilitated, I’m going to make sure that that kind of shit ends now.”

Tucker was incredulous: “You think this is my fault?”

[…]

“I know what happened. You f—ing stole money from people,” Therrien said. “I’m giving you the opportunity to come clean.”

“I don’t know who you are, Andrew,” Tucker said. “Who are you?”

“A person that you f—ed with too many times.”

The entire story is a compelling must read at Bloomberg.com.

These are just a few examples of phantom debt scams; and unfortunately, many more exist. If nothing else, when a debt collector calls, even if you are aware of the debt, follow the steps above just to be safe.