People looking to improve credit scores need as many strategies as available to accomplish the goal.

Since 2019, Experian Boost helped more than 9 million consumers collectively grow their FICO® Scores☉ by nearly 15.5 million points according to Experian.com.

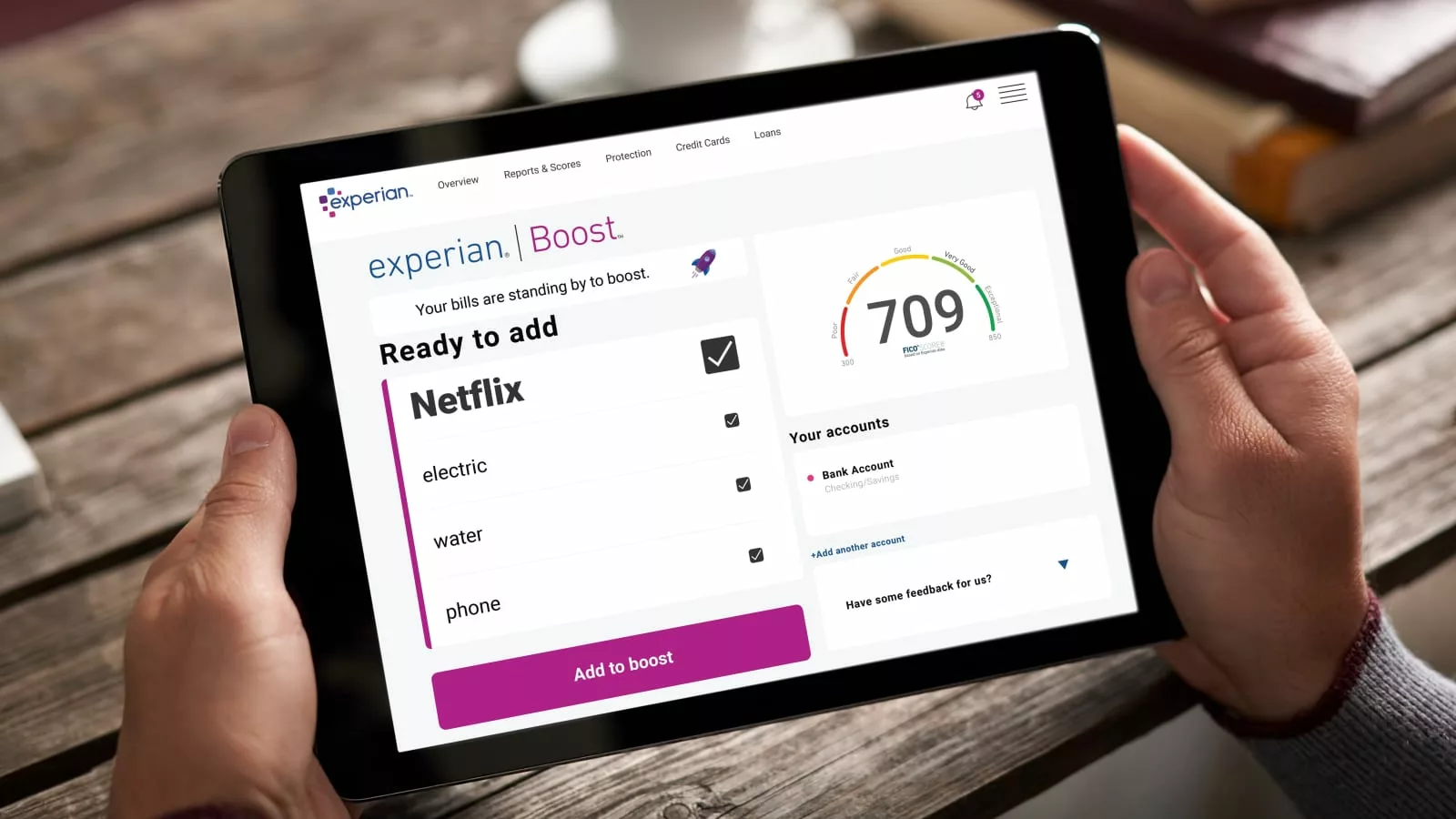

Experian Boost is a tool that allows users to include their utility bills, including internet, cable, gas, electric and water bill, and cell phone bill payment history in their Experian credit report.

How Does Experian Boost Work

Raise your credit scores with the Experian Boost tool by getting credit for on-time payments for common services paid with your checking account or savings account.

» No-ChexSystems Banks are available if you don’t have a bank account due to ChexSystems.

Start with your bank account used to pay bills.

Experian Boost works by connecting to your bank account to find qualifying on-time bill payments. Payment history plays a major role (35% of your credit score) in calculating a credit score. In fact, payment history is a top factor in keeping your credit scores low. Experian Boost provides an innovative solution by including on-time payments for utilities, phone bills, and streaming services in your payment history.

Experian determines what payments qualify.

Qualifying monthly payments include:

- Video streaming services like Netflix®, Disney+™, HBO™ and Hulu™

- Mobile and landline phone

- Internet

- Cable and satellite

- Gas and electricity

- Residential rent with online payments

- Video streaming services

- Water

- Power and solar

- Trash

Choose accounts you want added to your credit history.

You get to choose and verify the positive payment data you want added to your Experian credit file. You can link positive payment data as far back as 24 months. The accounts must be in your name and the bills have 3 payments in the last 6 months (including 1 payment within the last 3 months). Experian Boost won’t track any payment history data you don’t want to be included.

How Experian Boost handles late payments.

Experian Boost does not include late payments of cell phone, utilities, rent or streaming services. The platform only pulls positive payment history. Experian Boost only pulls information that will help your FICO® Score. If you miss a utility bill after using Experian Boost, they’ll overlook this data.

Receive an updated FICO score.

Experian updates your credit report to include the positive payment history from bills you choose to include. Experian Boost includes access to your Experian credit report and FICO score, both updating every 30 days. You get real-time results.

Can Experian boost hurt your credit score?

No. If you decide the service isn’t for you, you can remove your data via Boost at any time.

How many points will Experian Boost add to FICO® Scores

Based on Experian data, the average user sees a 13-point increase in their FICO® Score 8, but there’s no guarantee. What’s even better is the increase in score is immediate! Experian Boost is a free service that can help you raise your FICO® Score in a matter of minutes.

According to Experian, “Out of each FICO credit tier—very poor (300-579), fair (580-669), good (670-739), very good (740-779), and exceptional (780-850)— the majority (87%) of people with a very poor score who used Experian Boost saw their FICO® Score increase. Among people with a fair score, 63% saw their scores increase.” If you are in the process of building credit, this may take you to the next step.

A good credit score saves you money and opens doors to new financial opportunities. Better credit scores give you access to favorable interest rates on new loans, which could save you hundreds or even thousands of dollars over the life of the loan.

How to Sign-Up for Experian Boost

Signing up for Experian Boost is free and easy.

- When you go to the Experian Boost page, you’ll be asked to create a free Experian account to start the process.

- You’ll then connect your online bank accounts so Experian can search for any qualifying on-time payments.

- Once you verify that you want to add the accounts to your credit file, your credit scores will be calculated using the newly added payment information.

- The process is simple, and if you receive a boost, you’ll see your FICO® Score increase in just a few minutes.

FICO® Scores are used by 90% of top lenders. Experian boost does not impact your credit reports or scores at Transunion and Equifax.

Final thoughts

FICO 8 and FICO 9 are currently the credit scoring model most widely used by lenders. If you pay a streaming service like Netflix, a utility or cell phone bill using your bank account, consider trying Experian Boost. It may increase your credit score with Experian instantly.

While on-time Netflix payments aren’t going to give you a 100-point score increase, a few extra points can boost you to better interest rates. The average credit score increase of 13 points. Results may vary but Experian Boost can be a cheaper alternative to credit repair companies.

Since Experian Boost only reports positive payment histories; and, it’s free, see if you can get a credit score boost, it won’t hurt your credit scores.

APPLY NOW