The VantageScore scoring model was created as a joint venture among Experian, Equifax and Transunion to compete directly with the FICO (Fair Isaac Corporation) credit scoring model and offer choice in the credit score marketplace.

The VantageScore scoring model was created as a joint venture among Experian, Equifax and Transunion to compete directly with the FICO (Fair Isaac Corporation) credit scoring model and offer choice in the credit score marketplace.

The VantageScore has been around since 2006 but the question of how many lenders use VantageScore is not exactly known.

It has been 6 years since the introduction of VantageScore and it appears its creators have been unable to sell many lenders on their product. VantageScore 2.0 is the latest version of the model.

Fair Isaac Corporation has been around since the 1950s, using different risk scoring models, and is most widely used. FICO’s website states “90% of the largest banks use your FICO credit score for credit decisions” and FICO holds 74% market share of the industry. VantageScore has only captured 5.7 percent of the credit scoring market since its introduction.

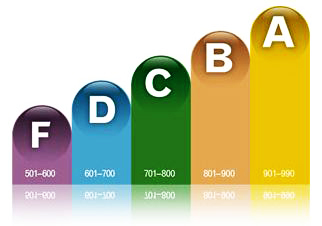

FICO engaged in a 4 year court battle with Experian, Equifax and Transunion to stop VantageScore Solutions from using any numbers that overlap the 300-850 range, used by FICO. That would result in VantageScore being able to only use 0-299 or 851 to 999, which would prohibit VantageScore from creating a valid credit system as neither range is wide enough.

FICO did not prevail as a jury determined a score range could not be trademarked and in July 2010, a U.S. district judge dismissed FICO’s antitrust, false advertising and breach of contract claims.

VantageScore Solutions CEO, Barrett Burns stated “The court’s decision confirms our longstanding position that FICO’s claims are meritless.” “Their arguments have failed to convince a federal jury and judge. At every step, VantageScore has prevailed against Fair Isaac’s claims. Should FICO appeal, we remain confident we will prevail there too.”

Breakdown of lenders using VantageScore

According to VantageScore’s CEO, Barrett Burns, in a hearing on “Keeping Score on Credit Scores” before the Subcommittee on Financial Institutions & Consumer Credit Committee on Financial Services on March 24, 2010, their scoring model is used by “many lenders, including:

4 of the top 5 financial institutions

8 of the top 10 credit card issuers

3 of the top 10 mortgage originators

7 of the top 50 auto lenders.

Which Credit Scoring Model matters most to Consumers

I have not been able to determine any major difference in the VantageScore and the more popular FICO credit score, except in one category which is discussed further in this article. VantageScore ranks consumers on the odds of becoming 90 days or more past due on a credit obligation within a 2-year timeframe. The higher the VantageScore the least likely a consumer will default. The lower the VantageScore the odds get much higher that a consumer will default on credit obligations.

FICO credit score measures the odds a consumer will become severely delinquent. According to FICO severe delinquency is defined as a consumer becoming 90 or more days past due in the 24 months after the score is calculated. As you can see, both VantageScore and FICO credit scoring models are very similar.

VantageScore touts their credit score as being more consistent and “highly predictive” than the FICO score because the 3 major credit bureaus use the same credit scoring model to create the VantageScore. Industry experts say there is no real difference between the credit scoring models because the components is used to determine the credit scores is basically the same.

VantageScores favor Consumers with little Credit History

I think the category where VantageScore comes out ahead of FICO scores is with consumers who have little credit history or what is referred to as “thin credit files.” Consumers just starting to develop credit histories may benefit from the Vantage credit scoring system. Those consumers include the following:

- Young adults just starting their careers

- Recently divorced or widowed individuals with little or no credit in their own name

- Newly arrived immigrants

- Previous bankrupts

- People who shun the traditional banking system by choice

VantageScore provides lenders a predictive scoring system to extend credit to a greater percentage of thin file consumers. Thin file consumers are considered to be those who have three or fewer trades in their credit file. It is estimated that between 35 and 50 million adults in the United States may be considered unscorable.

This category of consumers may experience a denial of credit or pay more in interest rates if credit is granted. VantageScore expands the trade update criteria from six months to 24, allowing VantageScore to score people who may have been “out of the credit market” for up to two years. VantageScore also includes consumers with tradelines that are less than 6 months old.

Research the lender before applying for credit

When applying for credit consumers need only be concerned with the scoring model the lender uses — FICO or VantageScore. If you have higher credit scores with FICO but the lender uses only VantageScore, the higher FICO credit scores will not matter to that lender.

In order to get the best interest rates, shop around. If your better credit score is with FICO, locate lenders that use FICO scores and only apply for credit at those companies. All it takes is a quick telephone call or even an email to a lender; most find no harm in consumers requesting credit approval criteria in order to get the best rates and terms.