Check your credit reports for free every week. Becoming aware of the information in your credit reports puts you in charge.

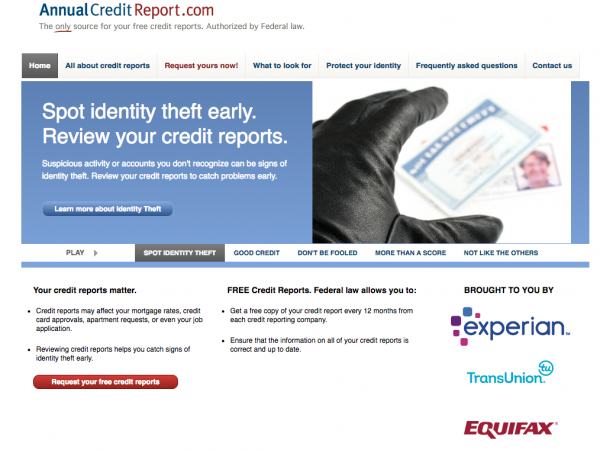

The government-mandated AnnualCreditReport.com website gives you access to a free credit report from Experian, Equifax and Transunion once a week.

Plus, due to constant data breaches and cyber security identity theft, the federal government now requires the three major credit bureaus — Experian, Equifax and Transunion — to offer FREE credit freezes. Parents can also freeze a credit file for a child under 16. It also has a provision for guardians of vulnerable adults to lock down their credit reports.

Positive and negative information influence your credit history – especially your credit scores.

Knowing the information that exists about your credit history can help you make better financial decisions.

How to get your free credit report

The Fair and Accurate Credit Transactions Act (FACTA) allows consumers to get a free credit report from each credit reporting agency once a week.

Consumers can request one, two or all three of their credit reports at one time from AnnualCreditReport.com.

AnnualCreditReport is the Central Source set up by the three major credit reporting agencies: Experian, Equifax and Transunion. Once you arrive at Annualcreditreport.com take the following steps to get your free credit report:

»1. Enter your personal information – Name, Social Security Number and date-of-birth.

»2. Request a free credit report or reports – You can order one, two, or all three reports.

»3. Answer security questions about your credit history – You’ll have to answer a few questions about your credit history for each report you request – for example, the approximate amount of your car payment or who holds your auto loan.

»4. Generate your credit report online – You can save them to your desktop or print them out so you’ll have access later. Free credit reports can also be requested by phone or mail. You won’t have to answer security questions if done by mail or phone.

»You can also get your credit reports by calling 877-322-8228.

»Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Your free annual credit report does not include your credit scores. Credit scores from sites like CreditKarma are Vantage scores. They are not the primary scores used by most lenders.

myFico.com is where you can get the actual credit score used by most banks and lenders. Getting a free credit report can help you detect identity theft.

Many times people don’t discover identity theft until they are contacted by an unknown creditor. At that point, the damage is done because bills have already been created with fraudulent accounts. Free credit reports can tip you off to mistakes or to identity theft, so checking even more often can be smart.

Other ways to get a free credit report

- Denial of Credit. The Fair Credit Reporting Act says that you are entitled to a credit report if you have been denied credit due to information in your credit report. You can request a free credit report from the credit reporting agency which denied you within 60 days of learning that you were denied.

- Seeking Employment or Unemployed. You can get a free credit report within 60 days of seeking employment. You must contact the credit reporting agencies and inform them you will begin seeking employment and you need a free credit report under the Fair Credit Reporting Act.

- Denied Employment. If you have been denied employment based upon information, in whole or part, in your credit reports you are entitled to a free credit report rom the credit reporting agency where the information was obtained.

- Government Assistance. Receiving government assistance such as welfare entitles you to a free credit report under the Fair Credit Reporting Act.

- Fraud or Identity Theft. If you have reason to believe your credit reports are inaccurate due to fraud or identity theft you are entitled to free credit reports under the Fair Credit Reporting Act. You should also take the steps immediate to clear your credit report with an Identity Theft Report.

How to freeze credit reports

Freeze Equifax

You can easily freeze your credit with Equifax on their website, or via an automated phone line: 1-800-685-1111 (1-800-349-9960 for New York residents). If you’d rather talk to a human, their customer care number is 1-888-298-0045.

Freeze Experian

To freeze your credit at Experian, you can visit their online Freeze Center. You can also call 1-888-EXPERIAN (1-888-397-3742).

Freeze TransUnion

TransUnion allows you to place a credit freeze online. You can also add a freeze via the automated phone system (or opt to speak to a live agent) by calling 1-888-909-8872.

How long does negative credit remain on reports

Here’s how long the negative information collected by the credit bureaus is likely to stay on your credit report:

- Bankruptcy: 10 years from the date of filing for Chapter 7 filings and 7 years for Chapter 13 filings.

- Charge-offs 7 years. A charge-off is when a creditor or lender writes off the balance of a delinquent debt, no longer expecting it to be repaid.

- Closed accounts: 7 years if the account was paid late, no expiration date if the account was always paid on time.

- Collection accounts: 7 years from the last late payment on the original account.

- Inquiries: 2 years, even though after 1 year the inquiry is no longer calculated in your credit score.

- Late payments: 7 years from the date of the late payment.

- Judgments: 7 years from the filing date if paid; longer if unpaid.

Monitoring your credit report is the first step to better credit. You can’t fix what you don’t know about. Keep an eye out for common credit report errors such as:

- New accounts that you didn’t open

- Identity errors (incorrect spelling of name, wrong phone number or address)

- Incorrect reporting of account status (late payments when you’ve paid on time, closed accounts reported as open or being listed as the owner of an account when you’re an authorized user)

- Data management errors (reinsertion of incorrect information after it was corrected)

- Balance errors (incorrect current balance or credit limit)

If you notice any errors, dispute them immediately. Also, check out our step-by-step extensive guide on how to fix your credit.

What to do about closed accounts on credit reports

Positive payment history. You may notice closed accounts on your credit reports. Don’t be alarmed, the closed account may be helping your credit scores. Closed accounts with a positive payment history (no late payment history) can remain on your credit reports for up to 10 years. Positive credit accounts contribute to a stronger credit history. So, removing those accounts could hurt your credit scores.

Negative payment history. Late payments made on an account can remain on your credit reports for seven years. Closing the account won’t remove the late payments any sooner. Late payments are removed at the seven-year period unless you are able to dispute late payments to have them removed sooner.

Delinquent closed accounts can remain on your credit reports for seven years after the original delinquency date when the first missed payment occurred and the account was never brought current.

Understanding Credit Reports and Scores – Get the inside scoop on how to spot errors and what items to update, correct or delete.

Monitor your credit scores after you get free credit reports

Checking your free credit reports gives you first-hand knowledge of what’s being reported about your credit history. But a free credit report does not include credit scores. It’s smart to monitor your credit scores as well. Most decisions involving credit stem directly from your credit score.

A lender may check one or all of your credit scores. Each credit bureau generates a FICO credit score when your credit report is pulled. FICO is the most popular credit scoring system used by 90% of lenders.

Unfortunately FICO scores aren’t free. But’s its still worth monitoring. FICO scores are available at myFICO.com.