Consumers Credit Union of Illinois is a credit union anyone across the U.S. can join. The low-rate auto loans make Consumers Credit Union of Illinois an attractive banking option.

About Consumers Credit Union

Consumers Credit Union (CCU) is based in Illinois with over 100,000 members and $1.2 billion in assets. Established in 1930, Consumers Credit Union is a comprehensive financial institution that provides a wide range of services, including checking and savings accounts, credit cards, loans, mortgages, online banking, and business services.

Who Can Join Consumers Credit Union

Membership is open to everyone and costs a one-time fee of $5, which goes to the Consumers Cooperative Association. Once your account is open, Consumers Credit Union will fund that amount as well as place $5 in your Share (savings) account.

Consumers Credit Union (CCU) Main Product

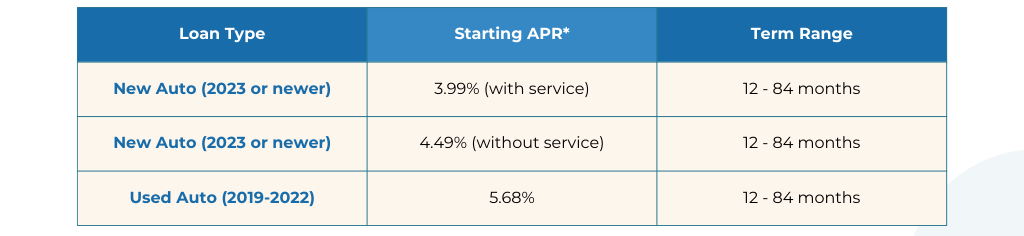

Auto loans are a major product at CCU with rates as low as 3.99% APR. That’s not surprising. Credit unions as a group have been major players in auto lending. In late 2022, credit unions accounted for nearly 30% of all vehicle loans in the U.S.

Competitive Rates & Discounts:

CCU offers rates as low as 3.99% APR if you use their Car Buying Service, or 4.49% APR without it. Borrowers can also get a 0.25% rate discount for setting up automatic payments, even from non-CCU accounts. Used vehicles (2019–2022) start at 5.68% APR.

*Not all applicants may qualify for the fixed base rate. Your rate is determined by your credit history and the use of Consumer Credit Union’s Car-Buying Service.

How the Car-Buying Service Works

Search and Compare Vehicles:

Members can browse new and used cars from top brands, compare features, read reviews, and find discounted, upfront pricing from local dealerships through the TrueCar-powered platform.

Lock in Your Price:

Once a vehicle is selected, you can lock in the upfront price online, which includes available incentives and discounts, so you know exactly what you’ll pay before visiting the dealership.

Pre-Approved Financing: You can get pre-approved for a Consumers Credit Union auto loan before heading to the dealership, saving time and giving you confidence during negotiations.

Trade-In or Sell Your Car:

The service also allows you to get a cash offer for your current vehicle in minutes, which you can use as a trade-in or simply cash out.

Buy with Confidence:

By using the service, you go to the dealer knowing the price and financing terms in advance, reducing surprises and haggling.

Loan Rate Discount:

If you purchase your vehicle through the CCU car-buying service, you receive a 0.50% discount off your auto loan’s annual percentage rate (APR).

No Down Payment Required:

Qualified buyers can finance 100% of the vehicle’s price.

Same-Day Funding:

In some cases, CCU can fund your auto loan the same day you apply, helping you get on the road faster.

Nationwide Access:

The service is available to members in all 50 states, and anyone can join CCU online. The platform provides transparent, upfront pricing and helps you avoid dealership negotiations along with the 0.50% APR discount that can make a significant difference in your total loan cost. You can handle research, financing, and trade-in offers all in one place.

Consumer Credit Union Auto Loan Features

100% Financing:

Qualified buyers can finance the entire purchase price of the vehicle, with no down payment required.

Flexible Loan Amounts and Terms:

Loan amounts range from $250 up to $500,000, with terms from 12 to 84 months, accommodating everything from economy cars to luxury vehicles.

Skip Payment Feature:

Members can skip up to two payments per year without a fee, providing flexibility during financial hardship (interest continues to accrue).

No Origination or Processing Fees:

There are no hidden fees to start your loan, and CCU also allows co-signers and co-borrowers.

Same-Day Funding:

In some cases, CCU can fund your car loan the same day you apply, expediting the buying process.

Nationwide Availability:

Although based in Illinois, CCU auto loans are available to members in all 50 states, and anyone can join online by opening a $5 share savings account.

Pre-Qualification with Soft Credit Check:

You can check your rate and eligibility without affecting your credit score.

Are Credit Unions FDIC-insured?

No. Credit Unions are federally insurance by the National Credit Union Association. Deposits are insured to at least $250,000 by the National Credit Union Association (NCUA), a US government agency.

This is the same level of federal insurance offered by banks and is backed by the full faith of the US government.

Consumers Credit Union of Illinois provides a range of financial products and services to meet the needs of its members, with a focus on competitive rates, low fees, and exceptional customer service.

Final takeaway

The Consumer Credit Union provides car loans for purchasing new and used cars, as well as refinancing.

Compared to other auto lenders, CCU is highly flexible and imposes no restrictions on vehicle age or mileage. Plus, CCU provides a 0.25 percentage point discount on rates if automatic loan payments are set up. CCU’s website allows member to obtain an interest estimate without affecting your credit score.

However, if the member decides to proceed with an auto loan, CCU will initiate a hard credit pull, which may slightly reduce the member’s credit score.

It’s important to note that CCU’s auto loans are best for borrowers with fair to excellent credit who want flexible qualifying criteria and a rate reduction with automatic payment.