It’s tough to live with low credit scores. When you neglect bad credit, basic financial dealings become much more expensive and difficult to obtain.

It might be time for a credit fix.

Whether it’s turning on utilities, applying for an apartment or shopping for car insurance, bad credit scores will cost you. For example, insurance companies often charge higher rates for drivers with bad credit, it doesn’t matter if you have a pristine driving record. Never ignore bad credit.

Cell phone and cable companies may require a security deposit when your credit scores are low. Landlords often require tenants with bad credit to pay more in security deposits.

When you fix credit errors doors open up much easier to financial products and other basic necessities.

25 Credit Fix Tips

1. Remove outdated information from credit reports

Legally, the federal Fair Credit Reporting Act requires credit bureaus to delete certain information within very specific time frames. When old information has expired, your credit history should be continuously updated and purged of that outdated information. But that does not always happen.

Most negative credit like charge-offs, collection accounts and late payments can remain on credit reports 7.5 years. Chapters 7, 11 and 12 bankruptcies remain for 10 years. Check your credit reports to ensure all outdated tradelines have been removed. Get a free copy of your Experian, Transunion and Equifax credit reports at annualcreditreport.com.

2. Request early exclusion.

Early exclusion is not an official policy of the Fair Credit Reporting Act. It’s in the discretion of each credit bureau. Early exclusion is when the credit bureaus remove a negative tradeline several months prior to the official date that information is due to be excluded (removed) from your credit files. Transunion seems to be the most flexible with early exclusion. With Experian and Equifax you may have to call a few times to get a representative to agree.

Early exclusion can work for negative tradelines such as late payments, charge-offs, collection accounts, accounts included in bankruptcy and late payments.

Two options to get the early exclusion process started

- Call the credit bureau, with your credit report in hand, and tell the representative “I’d like your help in deleting some old tradelines from my credit report.” Basically you’d like “obsolete” items removed.

- Dispute online choosing the option “Obsolete” or “No longer liable for this account” in addition to adding the comment “According to my records this account is too old to be on my report.”

Early exclusion timelines by credit bureau

- Transunion may exclude tradelines up to 6 months early ⎯ (800-916-8800).

- Experian may exclude tradelines up to 3 months early ⎯ (800-493-1058).

- Equifax may exclude tradelines up to 2 months early ⎯ (877-784-2528).

These are just estimations based on individual consumers’ experiences. Your experience may vary with each credit bureau. If one representative tells you no, then try another; it could render a very different result.

3. Request tax liens be removed.

Tax liens should no longer be on credit reports as of April 16, 2018. The tax lien removal comes as a result of a study by the Consumer Financial Protection Bureau Study that reported issues with the way consumer disputes were investigated by credit bureaus. If you had tax liens, review your reports to ensure they have been removed.

4. Request civil judgments be removed.

Civil Judgments should no longer be on credit reports due to the same reason tax liens were removed. You still owe the debt but it is not part of your credit score calculation. Bankruptcy is now the only public record information that is collected by the major credit bureaus.

5. Remove duplicate negative credit items.

Make sure there are no duplicate negative credit items are reporting. Pay special attention to charge-offs and collection accounts. Once a charge-off account is sold to a collection agency, the balance must be updated to reflect a $0 balance even though the history of that account will continue being reported. The collection agency can also report the account because they now have collection authority.

But there are some instances where a collection agency will sell the debt to a different collection agency but not remove their credit reporting.

Multiple collection agencies cannot collect and report to the credit bureaus for the same debt. If a debt is sold to another collection agency, the collection agency that sold the debt is required to delete their reported collection. If you have collection accounts, review your credit reports to ensure only the original creditor is reporting along with the most current collection agency.

6. Remove variations of names and addresses.

Updating your personal information on credit reports is an important credit fix strategy. You’d be surprised at how many variations of your name, address, Social Security number, phone number, birthdates, and employer information are maintained on credit reports.

Your credit report should contain ONE version of your current name and ONE current address. Deleting outdated and incorrect personal information can improve your chances of a successful credit dispute.

7. Fix credit errors and mistakes

Credit report errors are common, but they can be fixed. Review your credit report for errors. Once you identify errors dispute that information with the credit bureau containing the error. If all three of your credit reports contain the error, you will have to dispute with each credit bureau.

It’s better to dispute in writing so you can explain why the negative item is wrong. Include any documents to support your dispute. When you dispute negative credit items there are specific things to look for. Check out “How to Dispute Negative Credit” for more insight.

8. Request goodwill removals for late payments.

There are legitimate instances where late payments are unintentional. Creditors are not going to advertise this but some will remove late payments as a goodwill gesture. You have to ask. In fact, you may have to ask more than once. Get tips on how to use a goodwill request to remove late payments. Now there are instances where late payments are due to job loss or some other hardship. These types of late payments are harder to remove but there are strategies to remove late payments you can try.

Late payments can remain on credit reports for 7 years but as a late payment ages, it impacts your credit scores less. Concentrate on late payments that occurred in the last 2 years.

9. Request debt verification for collection accounts.

We’ve all heard stories of rogue debt collectors making life miserable for people. While there are many legitimate debt collectors, it doesn’t mean you don’t have the right to ask legitimate questions about a debt. The Fair Debt Collection Practices Act regulates debt collectors and allows you to request the debt collector provide verification of a debt they are attempting to collect.

Legitimate debt collectors will try to obtain accurate records so they don’t pursue people who don’t really owe the debt.

Debt validation helps you answer questions you may have about the debt:

- Is the debt yours? Requesting debt validation helps verify the debt is yours.

- Is the debt too old to collect? Junk debt buyers are known for resurrecting debt that is past the statute of limitations, so a debt collector cannot successfully use the courts to collect. Also, the debt may be too old to appear on credit reports.

- Is the debt collector legitimate? The booming industry of identity theft has made it simple for a fake debt collector to create a bogus debt collection notice.

- Is the debt already paid? You may not recall paying a debt years ago is a good reason to request verification.

- Has the debt ballooned? Has the debt collector added interest, fees, and costs to the debt that seem extreme? Requesting debt validation can help you understand how the amount owed was calculated.

- Is the debt collector authorized to collect the debt? Did the original creditor sell or transfer the debt to that particular debt collector? How would you know unless you request verification.

The bottom line is it makes perfect sense to request debt validation from a debt collector. In what world would you pay money to someone who says you owe them, but can’t properly verify the debt and has no documentation supporting their demand for payment?

10. Timely payments matter – a lot.

Get current if you’re currently not paying on time. Nothing is more important to credit scores than making your payments on-time. Set up automatic bill payment if necessary. Payment history makes up 35% of your credit score. One late payment can reduce your credit score by up to 110 points.

Other factors in your score are:

11. Always pay the minimum due or your account could be charged-off.

Paying the minimum due on your accounts is not ideal for reducing debt but it can save your credit card account from being charged-off. A reader was shocked when her credit card company charged-off an account balance because she was paying less than the minimum due on her credit card. Even though she was paying what she could it wasn’t enough to keep her credit card account in good standing. Always pay at least the minimum due on credit cards.

12. Deal with charge-offs.

When a bank charges-off an account, that means they have removed the uncollected balance from their books and charged against a bank’s loss reserves. A charge-off causes extreme damage to credit scores. But with any item on your credit reports the accuracy of a charge-off can be disputed in addition to other methods to deal with charge-offs.

13. Handle collection accounts.

Debt collection accounts are another credit score killer. But there are various ways to handle collection accounts. Dispute the collection account would be the first step. If it’s deleted as a result of the dispute, then your work is done. Another way to handle collection accounts is to settle with the debt collector for pennies on the dollar of the amount owed or offer a pay for delete agreement if the account is listed on your credit reports.

14. Request enrollment in credit card hardship program.

Having a hard time making the minimum payment on credit card accounts? Request a credit card hardship program. Many creditors are willing to work with you to change your payment if you’re facing a financial emergency. Your credit card company will want to know why you’re making the request, so you’ll need to be prepared to answer questions about your finances.

Depending on your situation, the credit card company may be able to:

- Reduce your minimum payment

- Reduce your interest rate

- Move your payment due date

- Get you on a fixed payment schedule

15. Reduce your credit card balances.

The amounts owed across all of your credit accounts as a percentage of your aggregate credit available accounts for 30% of your credit score. Credit utilization ratio represents the portion of your available credit that you actually use. The more available credit you use; the lower your credit scores. You can improve credit scores if you use less of your available credit limit.

Consider that FICO, the most widely used credit scoring formula, says the people with higher credit scores use 7% of their available credit limit. As a general rule, experts have said using no more than 30% of your available credit is standard. Just don’t max out your cards. Your credit score will drop since 100 percent utilization is seen as a precursor to defaulting.

16. Add positive accounts.

Pad negative credit accounts with good credit accounts. If your credit report contains nothing but negative credit, you need some current, good credit accounts to balance the negative. At least three positive accounts should be reporting monthly for example, a debit card that reports to the credit bureaus, a no credit check Visa and an unsecured credit card for bad credit like the Destiny Mastercard® are fairly easy credit cards to open.

Plus, there are secured cards you can open with as little as $200 that don’t require a credit check or a checking account. With the many ways to add positive credit, there’s no excuse for not having positive credit reporting monthly, even if you have to temporarily open a guaranteed approval credit card.

You can even have your on-time rent payments added to your credit reports.

17. Keep track of when credit cards report to credit bureaus.

Be in the know of when your credit card company reports to the credit bureaus. Having a low balance report monthly to credit bureaus will help increase credit scores. Most credit card companies update your payment and balance information once a month on the statement closing date. The statement closing date is separate from your payment due date. It’s the balance on the statement closing date that is reported to the credit bureaus.

That means if you have a payment due date of June 15th then typically the statement closing date will be approximately 3 days after the payment due date. The statement closing date is the date your utilization (amount owed) should be at 7% or less of your available credit.

18. Open a checking account if you’re using a prepaid card.

Checking accounts help you keep track of your finances. Online and mobile banking provides convenient access to account information. Plus, a checking account helps keep your money safe and is insured by the FDIC for up to $250,000. Free checking accounts, with no monthly or ATM fees, allow you to keep more of your money rather than a fee-driven prepaid card. But the most important benefit of a checking account is building a banking relationship.

When you find the right bank, it often leads to future financial products like mortgage loans, personal loans, auto loans, credit cards, and even investment and retirement accounts. Even if you have a ChexSystems record or EWS record, a second chance checking accounts will allow you to open a new account to start rebuilding your banking history.

19. Cushion your savings account for emergencies.

Many financial advisors suggest having an emergency fund equal to six months’ salary. An emergency fund can save your credit scores. Most people just don’t stop making payments on credit obligations for no reason. Illness, loss of income or major repairs and emergencies can end up setting people back for months when no emergency fund exists.

Then of course there are other reasons to have a savings account like funds for major life events, i.e., getting married or making a down payment on a home. Make saving money a habit. Put your money in a high interest savings account to reach your goals faster.

20. Get added as an authorized user for a quick credit fix.

Most credit card issuers let you add an additional person without having that person apply for the credit card themselves. Authorized users receive a credit card in their name and can use the card just the same as if he or she were the primary account holder. All purchases the authorized user makes go to the same account and appear on one credit card statement.

But more importantly an authorized user shares the same credit limit as the primary account holder without being financially responsible for paying the credit card. That means being an authorized user on someone’s account that is well-established, with a high credit limit and low balance, will help improve your credit scores and act as a quick credit fix. It can add vital positive account information when you need a credit fix and it’s a simple strategy to rebuild credit using credit cards.

21. Get credit line increases.

A higher credit limit can lead to better credit. Because credit scores are based, in part, on how much of your available credit you use, a higher credit limit can widen the space between your account balance and available credit. But there’s a catch. If your credit card company can increase your limit without pulling your credit report, go for it.

But if they have to pull a credit report, think twice. A hard inquiry can decrease your scores by up to 5 points, plus, a hard inquiry implies you’re shopping for more credit. If you’re planning to apply for a mortgage or car loan, too many inquiries may be problematic.

Before applying for a credit line increase, call your credit card company and ask can they increase your limit without a hard credit pull. Many times credit card companies perform soft inquiries throughout the year to see how you’re paying all credit obligations. If you ask, they may be able to use that credit report information from a soft pull they’ve already done.

22. Join the gig-economy.

Want to pay-off credit card debt or that nagging loan — get a temporary gig. There’s no shame in getting a temporary gig or second job to reduce debt. There are multiple creative ways to earn extra income to pay off debt. Sell an Ebook, join Fiverr or teach a class.

More temporary gigs can be found at:

And so many more. Just google “gig-economy.”

23. Consolidate credit card debt into an installment loan.

Installment loans report differently than revolving credit on credit files. It can make a big difference in credit scores if you consolidate credit card debt into an installment loan. With an installment loan, you borrow a fixed sum of money and agree to make monthly payments of a set dollar amount until the loan is paid off. While installment loan payment history is reported monthly to credit bureaus, it has less impact than revolving credit (credit cards) on credit utilization.

Plus, paying off debt will certainly help fix your credit and improve scores.

Payoff is an online lender offering loans to pay off and consolidate credit cards into one simple monthly payment. Payoff states consolidating credit cards into one payment will increase your FICO® Score by 40+ Points. Pay Off requires a credit score of 640.

If you need a loan to pay off credit cards with bad credit an online lender for bad credit can help. You don’t need a minimum credit score to qualify. You can even check your rate with no impact to your credit reports.

24. Rehabilitate defaulted student loans.

Student loan debt has reached the trillions, exceeding one-and-a-half times total credit card debt. It’s no surprise some borrowers may be struggling with defaulted student loans which can negatively impact credit scores. Consider student loan rehabilitation to recover your credit scores and get ahead of student loan debt.

Student loan rehabilitation requires 9 consecutive, on-time monthly payments to your loan holder. After the 9 successful payments, the loan will be picked up by a new servicer and the default will be removed from your credit history. Contact your lender and request rehabilitation if you have defaulted on student loans.

25. Make sure Bankruptcy is reporting correctly.

If you filed bankruptcy make sure your creditors are accurately reporting the bankruptcy filing. All the debts included in the bankruptcy should be reported as discharged through bankruptcy and the accounts that ARE included in the bankruptcy must show a balance of zero. If your credit report shows an improperly labeled discharged debt, you’ll want to dispute the error because it could be decreasing your credit scores.

Accounts included in the bankruptcy should NOT be reported as:

- currently owed or active

- late or delinquent or outstanding

- charged-off

- having a balance due, or

- given new account numbers or a new type of debt (that would be debt re-aging)

Extra Tip:

Call the credit bureau police!

Okay, I couldn’t help myself. But seriously, any problems you have with the credit bureaus, creditors, banks, student loans, and collection agencies, get help from the Consumer Financial Protection Bureau (CFPB). The CFPB governs how these entities conduct themselves.

They can intervene on your behalf to resolve disputes and other issues. It’s no secret that credit bureaus, collection agencies, banks, and lenders don’t always follow the rules. Submitting a complaint can get your dispute in front of human eyes. Always request negative credit items be deleted as your desired resolution of complaints.

What you can do with a good credit score

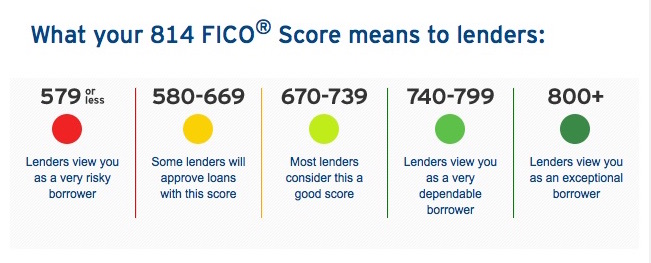

There are various credit scores but we’re going to focus on FICO scores because they are the scores used by 90% of top lenders. FICO scores range from 300-850. A good credit score ranges from 670 to 739 according to FICO. While it may not get you the lowest interest rates as those in the higher credit score range, it puts a borrower in the “acceptable” category.

Good credit is essential to low interest rates on mortgage, car and personal loans, not to mention credit cards. Entrepreneurs seeking start-up money along with seasoned small business owners benefit from good credit scores. The security of knowing you can borrow money when you need to, gives you peace of mind.

Resources:

Free Experian, Transunion and Equifax credit reports once a year

www.annualcreditreport.com

Free ChexSystems Report once a year

www.chexsystems.com

Free Early Warning Services once a year

www.earlywarning.com

Dispute Addresses for Credit Bureaus:

Experian

P.O. Box 4500

Allen, TX 75013

1-888-397-3742

TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

1-800-916-8800

Equifax

P.O. Box 740256

Atlanta, GA 30374

1-866-349-5191

Submit Complaints:

Consumer Financial Protection Bureau

www.consumerfinance.gov/complaint/

National Association of Attorneys Generals

www.naag.org/naag/attorneys-general/whos-my-ag.php

Better Business Bureau

www.bbb.org