Let’s face it, debt is stressful. The sooner you begin to make changes to get out of debt, the better your quality of life.

In Q4 of 2024, the total household debt reached $18.04 trillion according to the according to the Federal Reserve.

But that’s not all.

-

Credit Card Debt:Credit card balances rose by $45 billion to $1.21 trillion by the end of December 2024.

-

Auto Loan Debt:Auto loan balances increased by $11 billion to $1.66 trillion.

-

Mortgage Debt:Mortgage balances saw an increase of $11 billion, reaching $12.61 trillion.

As of March 29, 2025, the annual inflation rate in the US is 2.8%, according to the Consumer Price Index (CPI) data for February 2025.

Change is in order for U.S. consumers. Take action to carry as little debt as possible.

How to get out of debt

Your first thoughts about a budget may not be pleasant but hold on, creating a budget does not have to be difficult. Having a budget plan will help you decrease debt.

1. Keep track of expenses – write it down

Having a visible way to see where your money is going and what you can cut back on is key to get out of debt.

Basically, you want to include everything you spend money on in your budget. You may be surprised to see where your money is going and how you can save by cutting out frivolous items.

- Begin with your fixed expenses. Fixed expenses are your household necessities such as mortgage, rent, utilities, car payment, and insurance.

- Next, tackle your variable costs. Variable costs can change from month-to-month such as groceries, cell phones, credit card bills, entertainment, and clothing.

- Now, create a reserved budget. Reserved budget would be for things like dining out, vacations, hairstylists, haircuts and even pampering needs. Be realistic and set reasonable constraints on these items.

There are many budgeting Apps that can help you keep track of your budget and even the popular cash stuffing method. But, I prefer to write things down in old-fashioned book form. You can pick-up a budgeting planner like this $8.98 one from Amazon that allows you to write down daily, weekly and monthly expenses.

2. Cash, Cash, Cash

Using cash instead of credit cards and even debit cards can help you save money. Put your credit and debit cards away for a while and start using cash.

The act of using cash makes you more aware of your spending habits. Pulling out a credit card can give you a false sense of not having just spent money. Credit cards may also give you instant gratification but when you face the bill along with interest charges that gratification is long gone.

If you use a credit card try to carry one primary credit card and use it only for emergencies only such as car or home repairs.

Put your debit card away and you’ll instantly see how much money you are really spending. Even though you have the cash in your checking account, actually forking over cash when making purchases will open your eyes to anything you really don’t need.

3. Tackle credit card debt to increase your credit score

Stop using credit cards unless you plan to pay them in full each month. If you continue to use credit cards while attempting to get out of debt, you’re setting yourself up for failure.

Getting and remaining out of debt involves some behavioral changes. Stick to your cash and leave the credit cards at home. Pay more than the minimum due on credit cards.

There are financial risks when paying just the minimum payment on credit cards. One of the main risks is never getting out of debt plus paying just the minimum makes you look risky to other lenders.

The lower your balance, the higher your credit scores. Amounts owed on revolving debt like credit cards makes up 30 percent of your credit score.

Paying off just one credit card will improve your credit scores as long as you don’t create new debt.

Interest rates for mortgages, vehicles and credit cards are on the rise. But having a good credit score combats higher rates because you’ll get the lowest interest rates when seeking credit.

You don’t want to be chained to credit card debt year after year.

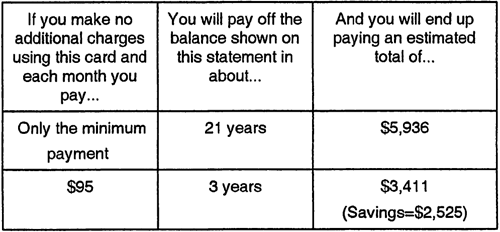

For example, here is a credit card statement where the total balance is $2720.12. The minimum payment is $54 and the APR is 15.24%. Assuming no further charges are made to the credit card, it would take 21 years to pay the balance in full when paying just the minimum payment of $54. Not to mention over $5,936 would be paid in interest.

Photo Credit: Fivecentnickel.com

Bumping the minimum monthly payment up to $95 the balance would be paid in full in 3 years which would save $2,525. But that’s still too much in interest. Add as much extra cash to your credit card payments as possible. You’ll save thousands of dollars in the long run.

Another way to tackle credit card debt is through debt consolidation loans. Lenders like SoFi Bank offer personal loans from $5k-$100k with low rates that can be used for debt consolidation. SoFi personal rates range from 8.99% APR to 29.49% APR depending on your credit score and other factors.

Check your rate without impacting your credit score. Plus, you will earn a $300 bonus after your loan funds. If you lose your job, SoFi can help modify your personal loan payments and help you find a new job.

If you’re wondering how debt consolidation impacts your credit score, you will be pleased to know debt consolidation will likely help your overall credit profile and scores over time.

Combining multiple credit card debt balances into one new loan — is likely to raise your credit scores over the long term if you use it to pay off debt.

You might see a slight decrease in your score after it appears on your credit report, but that’s okay. As long as you make payments on time and don’t rack up more debt, your score should go higher.

4. Cancel unwanted subscriptions

It’s easy to forget about subscription services you no longer use. Sometimes it’s just too many to keep up with. Whether it’s video streaming subscriptions, apps on your cell phone, gym membership, online data storage, cell phone service, or just old subscriptions, stop paying for services you don’t use or need.

Money can quickly add up for unused services that could be going to decreasing debt. Companies like Trim will help you analyze spending patterns to find ways to save you money and negotiate cable, internet, phone, and medical bills, as well as cancel old subscriptions.

5. Switch to Free Banking

If you’re paying checking account fees, prepaid debit card fees, or check-cashing fees ⎼ STOP! There are numerous banks that don’t charge monthly service fees. Online banks are a good choice for free checking accounts.

People unable to open a regular checking account due to a poor banking history should check out checking accounts for bad credit to get a fresh start. Monthly service fees can be as much as $205 a year!

6. Refinance student loans to get a lower rate

The Biden Administration’s move to cancel or lower student loan debt for qualifying borrowers of federal student loans has run into road blocks under the Trump administration. As of March 2025, over 8 million federal student loan borrowers are waiting for the courts to decide if their repayment plan is legal.

Currently, the federal office that oversees student loans has been cut in half and may be moving to the U.S. Small Business Administration (SBA). But neither the Education Department’s Federal Student Aid office, which manages the loan program, nor SBA have provided a timeline or details of a plan to move the portfolio.

It’s best for borrowers to stay up-to-date on repayment options by visiting the Federal Student Aid website. Biden’s SAVE Plan has been prevented by a federal court injunction along with parts of other income-driven repayment (IDR) plans.

However, the online income-driven repayment (IDR) plan and loan consolidation applications are available.

If you qualify for public-service loan forgiveness, apply and submit that certification form from your employer now, don’t wait.

Private Refinancing is still available.

Perfect credit is not required to refinance student loans. You could get a new student loan rate as low as 4.49% APR. With steep rates on your federal and private student loans, or Parent PLUS loans, it’s easy to save money by refinancing to a SoFi student loan. SoFi student loans do not charge application or origination fees plus, there are no pre-payment penalties.

7. Settle collection debt

Save money on debt that may be in collections. When you have overdue debt with a creditor, whether it’s an unpaid credit card balance, medical bills, or anything else, you may be in the position to settle the debt for pennies on the dollar. Always make your requests in writing to keep track of negotiations.

Collection agencies stand to make huge margins on purchased debt, so don’t be afraid to offer less than 25% of what you owe. Even if you offer to pay 25%, they’ll make a profit. The older the debt, the less you should offer for settlement.

8. Temporarily join the Gig-Economy

Extra cash is the quickest way to get out of debt. Temporarily join the gig economy to get out of debt sooner. Here are several at-home gigs and out-the-home gigs you can temporarily do to make extra cash.

Get paid for taking Surveys

- Prolific.com – Earn money by contributing to studies and surveys. Prolific offers higher payment than many other survey platforms. They have an extensive pre-screening system. Once you are pre-screened, Prolific will send surveys directly to your account throughout the day.

- Swagbucks – Sign-up and get a free $10 bonus right out of the gate. Earn points or Swagbucks by taking surveys, watching videos or searching the site.

- Inbox Dollars – Get paid for taking surveys, cash back shopping, trying new apps, exploring new products and services, playing games, and more!

- Opinion Outpost – Get paid for answering surveys.

- UserTesting – Earn cash to share your perspective on products and experiences.

Get paid to rent something

- Rent your truck – If you have a pickup truck, cargo van, or box truck market yourself as a mover, delivery driver or helper. Dolly on demand has $30 an hour moving jobs (helper jobs) for people that can lift least 75 lbs. If you don’t have a truck they have jobs (hand jobs) for $15 but you must be able to lift 75 lbs.

- Rent yourself as a friend – Earn money to be someone’s platonic friend.

- Rent yourself as a bridesmaid – Earn money to be a bride’sbridesmaid. Attend a movie or concert with someone that is willing to pay for a temporary hang-out friend.

- Rent a room – Earn extra money with your home and rent a room.

Get Paid for Rideshare and Delivery

- Drive for Lyft – Simpy apply online, meet vehicle and driver requirements, use the Lyft Driver app to accept rides, and earn money based on time and distance, with a guaranteed minimum earnings percentage. You can even rent a car through Lyft for driving.

- Drive for Amazon Flex or Fresh – Amazon relies on a network of delivery channels including drivers that can use their own cars for deliveries. Drivers can reserve a block and complete deliveries for parcels and groceries. Each block has an estimated total payout.

- Doordash – Sign up in minutes and start earning within days. You decide when, where, and how much you work.

- Instacart – All you need is your driver’s license, social security number, and bank account information to set up direct deposit.

- UberEats – Drive, deliver, do grocery shopping and much more.

9. Balance your Checkbook

Not surprisingly, many Americans don’t balance their. What checkbook you say? See what I mean. Online and mobile banking is so convenient but it does not necessarily mean you are more informed about your accounts.

Good old fashion basic math skills can save you a lot of money. Bank overdraft fees can range from around $10 to $40. Don’t give the bank an unnecessary bonus. Balancing your checkbook whenever you transact business using your checking account (writing checks, ATM withdrawals, bank service fees), will save you money.

Final thoughts

You never know when you’ll need money outside of your budget. Auto repairs, emergency travel, plumbing problems, a new furnace. You name it. The money you save by having a budget and sticking to it should go into a savings account. Having a high-yield savings account not only gives you peace of mind but also keeps you from incurring additional debt when an emergency occurs.

Just as you have a budget, building a safety net where you pay yourself first can keep you out of debt. Start with at least 10% of your income and you may even want to include it in your fixed expenses budget as a line item.

A good rule to follow is to have at least 3 to 6 months of living expenses saved for emergencies and even temporary unemployment.

The amazing thing about saving money is that the more you save, the more you want to save. You become accustomed to seeing that money in your savings account increase each month.

Banks aren’t paying much interest for savings accounts. In fact, the national savings account rate is around 0.41 percent. But online banks like CIT Bank offer higher rates.

Current banking has a 4.00% APY savings rate for up to a $6000 balance that’s 60x higher than the national average!

When you become debt-free you take a major step to improve your quality of life.